Please sign up as a member or login to view and search this journal.

Table of Contents

PAPER MONEY

VOL. XLV, No. 5, WHOLE No. 245 WWW.SPMC.ORG SEPTEMBER/OCTOBER 2006

1410,1"01X431Acii::.- -- •

N85978603 A

N95978603 A

NNIIIMMON , s

cell ...Arm mamma um

So you Mink you know small size?

OFFICIAL JOURNAL OF THE

SOCIETY OF PAPER MONEY COLLECTORS

Bel you'll iiml something new inside

this special issue devoted to . . .

Modern U.S. Small Size Notes

16804

TE STI PLATE

I

........

un

PREMIUM QUALITY BANKNOTES

for

IMMEDIATE SALE

• 4,1474.

1. 'DSTATESOFAMEMICA

Smythe offers a large selection of

choice banknotes for immediate

sale. If you are looking for Federal

Paper Money, World Bank Notes,

Confederate Currency, or Colonial

and Obsolete Bank Notes, please be

sure to contact us. You'll be glad

that you did.

To View Our HUGE Inventory

of Certified and Uncertified Small

Size, Large Size, Nationals, Obsoletes,

Fractional, and more, log on to:

SMYTHEONLINE.COM

For More Information, or Our

Latest Buy Prices, please contact

Scott Lindquist or Bruce Smart at:

800-622-1880

.000000551

t9f..4.4.1'.1tY.,

ala H

DAN

071 I:1471;

GEORGIA 1770. No UV/

HIS CERTIPICAIT

7 ONE , , PAN[6!i M ' 7.■

the Woe thereof, eceording to RA1011130l ofcONCRES.Y.

.111'

keipeocleuriein

Stew Goldsmith Scott Lindqui,t Bruce Smart

2

ux

F R5

Stephen Goldsmith

Past Presidehc

ESTABLISHED MO

R.M. Smythe & Co.

2 Rector Street, 12th Floor, New York, NY 10006-1844

TEL: 212-943-1880 TOLL FREE: 800-622-1880 FAX: 212-312-6370

EMAIL: info@smytheonline.com WEBSITE: smytheonline.com

We buy, sell, and auction the very best in Paper Money, Antique Stocks and Bonds, Autographs, Coins, and Anything Relating to Financial History

TERMS AND CONDITIONS

PAPER MONEY is published every other month begin-

ning in January by the Society of Paper Money

Collectors (SPMC). Second-class postage is paid at

Dover. DE 19901. Postmaster send address changes

to Secretary Robert Schreiner, P.O. Box 2331, Chapel

Hill, NC 27515-2331

© Society of Paper Money Collectors, Inc., 2006. All

rights reserved. Reproduction of any article, in whole or

part, without written permission, is prohibited.

Individual copies of this issue of PAPER MONEY are

available from the Secretary for $6 postpaid. Send

changes of address, inquiries concerning non-delivery,

and requests for additional copies of this issue to the

Secretary.

MANUSCRIPTS

Manuscripts not under consideration elsewhere and

publications for review should be sent to the Editor.

Accepted manuscripts will be published as soon as

possible; however, publication in a specific issue can-

not be guaranteed. Include an SASE for acknowledg-

ment, if desired. Opinions expressed by authors do not

necessarily reflect those of the SPMC.

Manuscripts should be typed (one side of paper only),

double-spaced with at least 1-inch margins. The

author's name, address and telephone number should

appear on the first page. Authors should retain a copy

for their records. Authors are encouraged to submit a

copy on a MAC CD, identified with the name and ver-

sion of software used. A double-spaced printout must

accompany the CD. Authors may also transmit articles

via e-mail to the Editor at the SPMC web site

(fredg spmc.org ). Original illustrations are preferred

but do not send items of value requiring Certified,

Insured or Registered Mail. Write or e - mail ahead for

special instructions. Scans should be grayscale or

color at 300 dpi. Jpegs are preferred.

ADVERTISING

•All advertising accepted on space available basis

•Copy/correspondence should be sent to Editor

•All advertising is payable in advance

•Ads are accepted on a "Good Faith" basis

•Terms are "Until Forbid"

•Ads are Run of Press (ROP)

unless accepted on premium contract basis

• Limited premium space available, please inquire

To keep rates at a minimum, all advertising must be

prepaid according to the schedule below. In exceptional

cases where special artwork or additional production is

required, the advertiser will be notified and billed

accordingly. Rates are not commissionable; proofs are

not supplied.

Advertising Deadline: Subject to space availability

copy must be received by the Editor no later than the

first day of the month preceding the cover date of the

issue for example, Feb. 1 for the March/April issue).

Camera-ready copy, or electronic ads in pdf format, or

in Quark Express on a MAC CD with fonts supplied are

acceptable.

ADVERTISING RATES

Space 1 time 3 times 6 times

Outside back cover $1500 $2600 S4900

Inside covers 500 1400 2500

Full page Color 500 1500 3000

Full page B&W 360 1000 1800

Half page B&W 180 500 900

Quarter page B&W 90 250 450

Eighth page B&W 45 125 225

Requirements: Full page, 42 x 57 picas; half-page may

be either vertical or horizontal in format. Single-column

width, 20 picas. Except covers. page position may be

requested, but not guaranteed. All screens should be

150 line or 300 dpi.

Advertising copy shall be restricted to paper currency.

allied numismatic material, publications, and related

accessories. The SPMC does not guarantee advertise-

ments, but accepts copy in good faith, reserving the

right to reject objectionable material or edit copy.

SPMC assumes no financial responsibility for typo-

graphical errors in ads, but agrees to reprint that por-

tion of an ad in which a typographical error occurs upon

prompt notification.

Paper Money • September/October 2006 • Whole No. 245 321

Paper Money

Official Bimonthly Publication of

The Society of Paper Money Collectors, Inc.

Vol. XLV, No. 5 Whole No. 245 SEPT/OCT 2006

ISSN 0031-1162

FRED L. REED III, Editor, P.O. Box 793941, Dallas, TX 75379

Visit the SPMC web site: www.spmc.org

FEATURES

Transition from Wide to Narrow Designs on U.S. Small Size Notes 323

By Peter Huntoon and James Hodgson

Mini-dollar: Shrinking Value of the U.S. Dollar 343

By Leslie Deerderf

Lucky Day Discovery: An Elusive Series 1928 $1000 Boston FRN 344

By Don Noss

Louis Van Belkum's "No Circulation" National Banks Revisited 345

By Lee Lofthus

Postscript to Postal Note: Fractional Currency Schemes After 1890s . 360

By Loren Gatch

On This Date in Paper Money History 367, 369

By Fred Reed

Is the Federal Reserve System a Governmental Organization? 370

By Stephen Zarlenga

Web Press Test Plate Varieties 385

By Bob Kvederas Sr. & Bob Kvederas Jr.

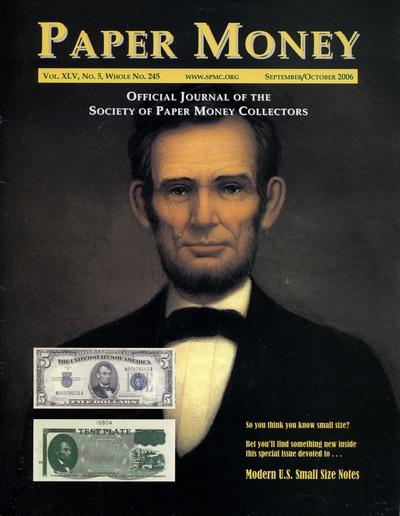

Did Lincoln's Appearance on Money Influence His Public Perception? 395

By Fred Reed

SOCIETY NEWS

Information & Officers 322

Society Members Benefit SPMC Programs with Their Gifts 355

Past President Ron Horstman steps down after decades of service 368

President's Column 378

By Benny Bolin

Money Mart 378

New Members 379

SPMC Memphis 2006 Board Meeting Minutes 380

Board membership opportunity to improve Society, hobby 382

SPMC honors J. Roy Pennell & Others 384

On the cover is Freeman Thorp's 1879 oil portrait of Abraham Lincoln based on an Alexander Gardner

photograph known as the "Gettysburg Lincoln," taken Nov. 8, 1863, days

before his speech. The painting was acquired by the U.S. Congress in 1920.

Lorenzo Hatch pro-

duced a security portrait

engraving for ABNCo

based on the same pho-

tograph, which the

Editor applied to a sug-

gested design for the $5

FRN makeover in 1999.

AreUrkial.

UNITED STA'TES

OP AMERICA

SOCIETY

OF

PAPER MONEY

COLLECTORS

INC.

ciation. The annual SPMC meeting

(International Paper Money Show).

322 September/October • Whole No. 245 • Paper Money

Society of Paper Money Collectors

The Society of Paper Money Collec-

tors (SPMC) was organized in 1961

and incorporated in 1964 as a non-

profit organization under the laws of

the District of Columbia. It is affiliated

with the American Numismatic Asso-

is held in June at the Memphis IPMS

Up-to-date information about the SPMC

and its activities can be found on its Internet web site www.spmc.org .

MEMBERSHIP—REGULAR and LIFE. Applicants must be at least 18 years of

age and of good moral character. Members of the ANA or other recognized

numismatic societies are eligible for membership; other applicants should be

sponsored by an SPMC member or provide suitable references.

MEMBERSHIP—JUNIOR. Applicants for Junior membership must be from 12

to 18 years of age and of good moral character. Their application must be

signed by a parent or guardian. Junior membership numbers will be preced-

ed by the letter "j," which will be removed upon notification to the Secretary

that the member has reached 18 years of age. Junior members are not eligi-

ble to hold office or vote.

DUES—Annual dues are $30. Members in Canada and Mexico should add $5

to cover postage; members throughout the rest of the world add $10. Life

membership — payable in installments within one year is $600, $700 for

Canada and Mexico, and $800 elsewhere. The Society has dispensed with

issuing annual membership cards, but paid up members may obtain one

from the Secretary for an SASE (self-addressed, stamped envelope).

Members who join the Society prior to October 1 receive the magazines

already issued in the year in which they join as available. Members who join

after October 1 will have their dues paid through December of the following

year; they also receive, as a bonus, a copy of the magazine issued in

November of the year in which they joined. Dues renewals appear in a fall

issue of Paper Money. Checks should be sent to the Society Secretary.

OFFICERS

ELECTED OFFICERS:

PRESIDENT Benny Bolin, 5510 Bolin Rd., Allen, TX 75002

VICE-PRESIDENT Mark Anderson, 115 Congress St., Brooklyn, NY

11201

SECRETARY Bob Schreiner, POB 2331, Chapel Hill, NC 27515

TREASURER Bob Moon, 104 Chipping Court, Greenwood, SC

29649

BOARD OF GOVERNORS:

Mark Anderson, 115 Congress St., Brooklyn, NY 11201

Benny J. Bolin, 5510 Bolin Rd., Allen, TX 75002

Bob Cochran, P.O. Box 1085, Florissant, MO 63031

Wes Duran, P.O. Box 91, Twin Lakes, CO 81251-0091

Gene Hessler, P.O. Box 31144, Cincinnati, OH 45231

Robert J. Kravitz, P.O. Box 6099, Chesterfield, MO 63006

Tom Minerley, 25 Holland Ave #001, Albany, NY 12209-1735

Judith Murphy, P.O. Box 24056, Winston-Salem, NC 27114

Fred L. Reed III, P.O. Box 793941, Dallas, TX 75379-3941

Robert Schreiner, P.O. Box 2331, Chapel Hill, NC 27515

Wendell A. Wolka, P.O. Box 1211, Greenwood, IN 46142

Jamie Yakes, P.O. Box 1203, Jackson, NJ 08527

APPOINTEES:

PUBLISHER-EDITOR Fred L. Reed III, P.O. Box 793941. Dallas.

TX 75379-3941

CONTRIBUTING EDITOR Gene Hessler, P.O. Box 31144,

Cincinnati, OH 45231

ADVERTISING MANAGER Wendell A. Wolka, P.O. Box 1211,

Greenwood, IN 46142

LEGAL COUNSEL Robert J. Galiette, 3 Teal Ln., Essex,

CT 06426

LIBRARIAN Robert Schreiner, P.O.Box 2331, Chapel Hill, NC

27515-2331

MEMBERSHIP DIRECTOR Frank Clark, P.O. Box 117060, Car-

rollton, TX 75011-7060

PAST PRESIDENT Ron Horstman, 5010 Timber Ln., Gerald, MO

63037

WISMER BOOK PROJECT COORDINATOR Bob Cochran, P.O.

Box 1085, Florissant, MO 63031

REGIONAL MEETING COORDINATOR Judith Murphy, P.O. Box

24056, Winston-Salem, NC 27114

BUYING AND SELLING

CSA and Obsolete Notes

CSA Bonds, Stocks &

Financial Items

ANA-LM

SCNA

PCDA CHARTER MBR

HUGH SHULL

P.O. Box 2522, Lexington, SC 29071

PH: (803) 996-3660 FAX: (803) 996-4885

SPMC LM 6

BRNA

FUN

Auction Representation

60-Page Catalog for

$5.00

Paper Money • September/October 2006 • Whole No. 245

323

The Transition from V.11 /42 Narrow. Designs on

U.S. Small Size Notes

between 1947 and 1953

By Peter Huntoon and James Hodgson

Resizing Program

A PROGRAM TO RESIZE THE SMALL SIZE CURRENCY

designs began to be implemented at the Bureau of Engraving and

Printing during December 1947, when work on the narrow $5 FRN

face die was begun. The program concluded with the hardening of

the narrow $5 and $10 back dies on September 20, 1950.

Above: A just discovered narrow $10

Series of 1934C narrow Kansas City

face shown with a wide that was on the

same press at the same time for com-

parison. Only four narrow Series of

1934C face plates were made, all for

Kansas City.

The stated purpose for the resizing program written on the die cards for

the narrow face designs was to make all the engravings the same size as the $1

SC face which was designated as the standard. All the designs that were resized

originally had been engraved a bit larger than the $1 SC face.

Similarly, the backs were resized to a uniform common standard which

was smaller than the $1 SC faces. Although not stated, it appears that the $50

and $100 backs served as the standard.

The following were resized: $2, $5, $10, $20, $50 and $100 faces, and $1,

$5, $10, $20 backs. Left untouched were the $2, $50 and $100 backs, and, of

course, the $1 face.

A primary benefit flowing from the resizing program was that the spaces

between the subjects on the plates were larger in the shortened dimension.

This reduced spoilage rates. It is likely that reduction of spoilage rates was the

driver for the program.

The resized designs were used on 12-subject flat plates. The last of the

12-subject plates were Legal Tender $2 Series of 1928G and $5 Series of

1928F; Silver Certificate $1 Series of 1935D and, $5 and $10 Series of 1934D;

and all Series of 1950 Federal Reserve Notes.

324 September/October • Whole No. 245 • Paper Money

Discovery

Wide and narrow designs were discovered decades ago on the $1, $5 and

$10 backs, and listed in the earliest Goodman, Schwartz and O'Donnell cata-

logs. However, the narrow $20 back was recognized only within the past few

years by Jim Hodgson.

The narrow $5 SC face was discovered in the fall of 2003 by Bill Recob,

an attendee in a paper money class taught by Peter Huntoon at the University

of Nevada at Las Vegas. The narrow $5 LT face was found the next day just as

soon as Huntoon could get at his notes.

It was obvious that the wide to narrow transitions represented a signifi-

cant redesign effort that involved most of the small size issues. Huntoon

undertook a crash program to find the rest during a March 2004 trip to the

Smithsonian Institution where he could work with the certified proofs from all

the series.

Certain that new dies were prepared, Huntoon simultaneously inquired

of Cecilia Wertheimer at the Bureau of Engraving and Printing Historical

Resource Center to determine if she could locate records for them. She gra-

ciously complied and soon Eric Woodward of her office advised that he had

located a sheaf of die cards from the effort, all with notations such as "This

reduced size was attained in order to conform to the $1 Silver Certificate Face

which is the standard size."

The following new face varieties were discovered: $2 LT, $10 SC and

$5, $10, $20, $50 and $100 FRNs. In short order the list of the varieties had

more than trebled. The die cards coupled with a thorough search of the certi-

fied proofs at the Smithsonian demonstrate that we now have found them all.

No narrow design was prepared for $1 SC faces because that engraving

served as the standard size for the others. No narrow designs were made for

$2, $50 or $100 backs either.

Chronology

The dates that the narrow dies were hardened appear on Table 1. Those

are key dates because once hardened, the dies were ready for use.

Table 1. Chronological order in which the first narrow plate of each design was certified for use, and information on the

corresponding narrow die prepared with the new narrow design.

Date First Dimension Date Die

Den Class Side Plate Certified Shortened Die Numbera Hardened

5 SC face Aug 11, 1948 horizontal 16266 Jun 4, 1948

5 FRN face May 6, 1949 horizontal 331 Apr 23, 1948

10 FRN face Aug 25, 1949 horizontal 332 Aug 18, 1948

1 back Sep 22, 1949 vertical 16421 May 10, 1949

20 FRN face Oct 27, 1949 horizontal 335 Feb 28, 1949

2 LT face Dec 6, 1949 horizontal 16291 Aug 5, 1949

10 SC face Feb 10, 1950 horizontal 16472 Dec 12, 1949

5 LT face Mar 8, 1950 horizontal 16468 Nov 25, 1949

50 FRN face Mar 27, 1950 horizontal 337 Aug 23, 1949

100 FRN face Jun 2, 1950 horizontal 338 Feb 14, 1950

20 back Jul 3, 1950 horizontal 350 die card not found

5 back Nov 7, 1951 horizontal 368 Sep 20, 1950

10 back Dec 20, 1951 horizontal 371 Sep 20, 1950

a There are two series of die numbers, the 3 digit are Federal Reserve Note dies, the 5 digit are Miscellaneous dies.

Paper Money • September/October 2006 • Whole No. 245 325

Table 2. Key plates and dates associated with the changeovers between the 12-subject wide and narrow $2 and $5 Legal

Tender, and $5 and $10 Silver Certificate face designs.

The plate having the lowest number with a given variety was not always the first plate with the variety to be certified or

used. Conversely, the plate having the highest number with a given variety was not always the last plate with the variety

to be certified or used.

Last Last Date Last Date First First Date First Date

Wide a Wide a Wide Narrow a Narrow a Narrow

Plate Plate was Plate was Plate Plate was Plate was

Number Certified Used Number Certified Used

$2 Legal Tender wide to narrow transition:

1928F 481 Jun 11, 1947 Dec 9, 1949 1928G 483 Dec 6, 1949 no data

$5 Legal Tender wide to narrow transition:

1928E 627 Jul 27, 1947 May 1, 1950 1928F 628 Mar 8, 1950 Mar 13, 1950

$5 Silver Certificate wide to narrow transition:

1934C 2026 Jun 16, 1948 Mar 13, 1950 1934C 2028 Aug 11, 1948 Aug 18, 1948

$10 Silver Certificate wide to narrow transition:

1934C 232 Sep 9, 1947 Aug 7, 1950 1934D 233 Feb 10, 1950 no data

The work on the narrow designs appears to have commenced December

11, 1947, when the narrow $5 FRN face die was begun. The job was finished

December 20, 1951, after the first narrow $10 back was

made.

However, there was a peculiar reversion to use of wide

$5 backs beginning in April 1952 that continued to the end

of 12-subject plate production in 1953. The narrow design

was reinstituted when $5 18-subject back plate production

commenced March 31, 1953.

$2 Legal Tender Faces

Work on an horizontally shortened $2 face die was

completed in August, 1949, and the first plate made from the

narrow die was certified in December. As shown on Figure

1, the alteration to the die was simple. Slivers of the right

and left ends were trimmed away.

The changeover from the wide to narrow $2 faces

occurred between the 1928F and G series. No rarities were

created as a result. $2 1928F face 481 is the last wide, and $2

1928G face 483 the first narrow (Table 2).

No narrow version of the $2 backs was needed, so

there are no wide and narrow back designs to create interest-

ing matings with the available faces.

$5 Silver Certificate Faces

Work on a narrow $5 Silver Certificate face die began

during January 1948, and the die was hardened in June. It

was the first of the narrow dies to be completed. The first

plate made from the die was certified in August, and was the

first narrow plate to be made under the resizing program.

Figure 1. Comparison between the wide and narrow $2 Legal Tender

faces. Notice the degree of horizontal shortening.

Wide

Narrow

Wide

326 September/October • Whole No. 245 • Paper Money

JAMES POLIS

BUYING AND SELLING QUALITY COLLECTOR

SMALL SIZE CURRENCY

WHY WOULD YOU WISH TO DEAL WITH ME?

PROFESSIONALISM

It is my promise to you, the customer, that you will always be treated with the most

ardent professionalism regarding all matters.

AFFILIATION

I am a member of the Professional Currency Dealers Association,

Society of Paper Money Collectors, Fractional Currency Collectors Board,

and American Numismatic Association.

CONSERVATIVE GRADING

I am one of the most conservative graders in the hobby (ask anyone who has ever dealt with me).

A UCTION REPRESENTATION

Very competitive rates offered — I attend most of the major currency auctions.

MAJOR ADVERTISER

Check out my full page ad on page 17 in every issue of the Bank Note Reporter.

FREE PRICE LIST

Occasionally available upon request.

WANT LISTS SERVICED

I attend many of the major shows and auctions to satisfy

my customer's collecting needs.

SEE WHAT ONE CUSTOMER STATES IN RESPONSE TO HIS ORDER

THIS IS AN EXAMPLE OF MANY OF MY CUSTOMERS THOUGHTS

"Hello Jim,

The two FRNs arrived today safe and secure. Thank you for the very fast delivery.

My feelings about the condition of the two notes: First the 1985 $20... Perfect, Beautiful, better than expected. Now,

the ever so elusive 1963 $20 that has been a royal pain in my butt to find for the last 7 months.... First, understand that the

price was more than I wished to have spent, even though it's been a tough and difficult note to secure. Second, you had me

a bit worried about the possible centering condition, so I was expecting a note that had or might have had some disappoint-

ing visual aspects that honestly had me thinking twice about spending the amount you wanted for the note in the first

place. WOW WEE.... It's simply Great, the margin shift is, as you said and tried to assure me of, slight. Not a big deal at all.

The note is stunning. I could not have wished for a better note. I am completely overwhelmed by it's beauty and freshness.

What a relief to have found such an awesome example. Now I have absolutely no second thoughts about the price. Seeing it,

holding it, feeling it, having it... It was a no-brainer to have bought.

In short, I suppose you could say I'm happy to put it in a single word. Thanks Jim, you have an excellent eye for

quality. Your contact, service and delivery are an asset to your profession. I'm so very glad a friend of mine, who I know

only through buying notes on ebay, and share the enjoyment of collecting for the last 8 months, sent me your name, email

listings and address.

You've got a customer for life here. No second-guessing your expertise, notes and service on my part at all now.

Thanks for the super notes!"

Jeff "

Paper Money • September/October 2006 • Whole No. 245 327

ACTIVELY ACQUIRING THE FOLLOWING

LEGAL TENDER NOTES

From high grade type notes to rare stars

SILVER CERTIFICATES

Vigorously searching for key issues but will also gladly accept

nice uncirculated type notes

FEDERAL RESERVE BANK NOTES

Strong buyer of all type notes as well as challenging rarities

GOLD CERTIFICATES AND EMERGENCY CURRENCY

All notes from all denominations in most collectible grades

FEDERAL RESERVE NOTES

Desperately seeking the following in all grades:

Numbered District Notes

Early Star Notes — 1928 — 1934 issues

Other key issues such as 1950E, 1963, and 1969B

High Denomination Bills

FRACTIONAL CURRENCY

I am one of the strongest buyers in this field. Take a look at any major auction

or show at who is buying fractionals in all grades and you will usually hear

my name. I am passionately looking for all scarcer varieties as well as Choice-Gem

Uncirculated Type Notes for my customers. Please send me any notes that

you have for a fair and expedient offer

COLONIAL CURRENCY

I am interested in all colonies but specifically scarcer ones such as Georgia, New

Hampshire, The Carolinas, Virginia, as well as more difficult issues from all colonies

LARGE SIZE TYPE NOTES

I would like to purchase any large size type notes available

CONFEDERATE CURRENCY

Specifically interested in scarcer types

JAMES POLIS

4501 Connecticut Avenue, NW #306

Washington, DC 20008

(202) 363 — 6650

Jpolis7935@aol.com

Figure 2. Comparison between the wide

and narrow $5 Silver Certificate faces

showing the degree of horizontal short-

ening.

Wide Narrow

Figure 3. The easiest way to distinguish

between the wide and narrow $5 Silver

Certificate faces is to count the numbers

of pairs of vertical lines to the left of the

tip of the line that defines the center of

the spiral next to the lower right counter.

September/October • Whole No. 245 • Paper Money

Wide

Narrow

328

The most obvious place to see the differences between the wide and nar-

row varieties is in the spiral that touches the left side of the lower right counter

(Figure 2). The most definitive feature is the number of pairs of vertical lines

to the left of the tip of the curled line that defines the center of the spiral. As

shown on Figure 3, there are three pairs of two lines on the wide, but only

nvo on the narrow. The diagnostic features shown on Figure 2 are mirrored

on the left side of the notes as well.

The narrow face design first appeared on the last four plates made for

the Series of 1934C Silver Certificates, specifically plates 2028, 2029, 2030 and

2031. These plates were begun in June 1948, and finished in August. See

Table 3.

The last wide Silver Certificate face was 1934C plate 2026. It was certi-

fied June 7, 1948, and narrow 2028 on August 11th. Consequently, this wide-

narrow changeover was the first of the known wide to narrow design changes.

Plate 2027 never was finished, but was begun as a narrow based on the fact that

work on it started in June along with the other four, and that it was manufac-

tured in the same fashion.

The data from the plate history ledgers summarized on Table 3 reveal

that all four of the narrow 1934C Silver Certificate face plates were used.

Printings from them spanned August 18, 1948, to January 11, 1950. However,

they represent only a small fraction of 1934Cs produced.

A total of 156 face plates were used to print the $5 Series of 1934C Silver

Certificates. The four narrow plates represent about 2.5 percent of this total.

Consequently the narrows should be about as scarce as regular 1934C star

notes, and the narrow star notes should be very scarce to rare.

Table 3. Comprehensive data for the four $5 Series of 1934C Silver Certificate narrow face plates.

Plate Begun Certified Reentered Recertified Canceled Logged Out

to Press Room

Last Series of 1934C wide face plate:

2026 May 21, 1948 Jun 7, 1948 Nov 20, 1951 Jul 8, 1948-Aug 25, 1949

Sep 23, 1949-Oct 17, 1949

Series of 1934C narrow face plates:

2028 Jun 10, 1948 Aug 11, 1948 Mar 10, 1949 Apr 1, 1949 Nov 20, 1951 Aug 18, 1948-Mar 9, 1949

Oct 14, 1949 Nov 7, 1949 Jul 8, 1949-Aug 25, 1949

Sep 23, 1949-Oct 13, 1949

2029 Jun 10, 1948 Aug 11, 1948 Jan 4, 1949 Jan 13, 1949 Nov 20, 1931 Aug 18, 1948-Jan 3, 1949

Oct 18, 1949 Oct 24, 1949 Jul 8, 1949-Aug 25, 1949

Jan 12, 1950 Feb 3, 1950 Sep 23, 1949-Oct 17, 1949

Oct 5, 1949-Jan 11, 1950

2030 Jun 10, 1948 Aug 11, 1948 Jan 4, 1949 Jan 13, 1949 Nov 20, 1951 Aug 18, 1948-Jan 3, 1949

Sep 23, 1949 Nov 7, 1949 Jul 8, 1949-Sep 22, 1949

Dec 6, 1949 Dec 8, 1949 Oct 5, 1949-Dec 5, 1949

2031 Jul 14, 1948 Aug 11, 1948 Jan 4, 1949 Jan 18, 1949

Oct 20, 1949 Oct 26, 1949

Jan 5, 1950 Feb 2, 1950

held for

exhibit or

modeling

Aug 18, 1948-Jan 3, 1949

Jul 8, 1949-Aug 25, 1949

Sep 23, 1949-Oct 19, 1949

Nov 5, 1949-Jan 4, 1950

Plate 2027 was begun June 9, 1948, but canceled unfinished on July 14, 1948. It appears to have been a narrow.

Plates 2028, 2029, 2030 and 2031 were the last $5 Series of 1934C Silver Certificate face plates.

Icg"-;-""-^-"7"-W.:"

MI

SR,e OF ■93a C

WASIIINGTON.I

Irlitjet

N85978603 A

THIS CERT

FORS, DE

pmcwesix maims maauinu fay Losmnaus,-,

N85978603 A

Paper Money • September/October 2006 • Whole No. 245

Micro back 637 was still in use during the first part of narrow 1934C pro-

duction! Specifically, it was on the presses between June 23, 1945, and June 14,

1949. Consequently, 637 back and 1934C narrow face production overlapped

from August 1948 to June 1949. Mule 1934C narrow faces were the result

(Figures 4a and 4b).

Rarer micro back 629 was in production only from November 17, 1947,

to February 2, 1948. It went out of production too early to have been mated

with any of the narrow faces.

Regular narrows occur in the NA, PA and QA blocks. The 637 mules are

on the NA and PA blocks.

Undoubtedly narrow regular and mule varieties also occur as star notes,

but none have been reported yet. If 637 narrow stars are found, they will be

great rarities, possibly rivaling the key to the $5 Silver Certificate series, the

Series of 1934A 637 star note.

$5 Legal Tender Faces

The wide to narrow change on the $5 Legal Tender notes also involved

an horizontal shortening across the notes. The shortening was accomplished in

identical fashion as on the Silver Certificates.

The changeover from wide to narrow on the $5 Legal Tender Notes

occurs between the 1928E and 1928F series. The $5 1928E face 627 is the last

wide, and $5 1928F face 628 the first narrow. The $5 Legal Tender plates

were not produced between July 1947 and March 1950, owing to low demand,

thus missing the end of the Julian-Snyder regime in 1949 when the narrows

first appeared on the Silver Certificates.

No rarities were created because the changeover occurred between the

1928E and F series. Also, the narrow 1928Fs arrived too late to be mated with

637 micro backs.

$5 Federal Reserve Faces

The manner in which the horizontal dimensions on the $5 Silver

Certificate and Legal Tender faces were shortened was identical. However, the

shortening across the bottom of the face of the $5 FRNs was accomplished dif-

ferently.

On Figure 5, notice how the tip of the curled line in the center of the

spiral along the bottom border stops one pair of vertical

lines short of the left side when compared to the SCs and

LTs on Figure 3. This distinctive difference is visually

enhanced by the fact

that the pairs of fine

lines within the spiral

on the FRN die were

cut a bit deeper so

that they printed more

boldly on the notes.

329

Wide Narrow

Figure 4a. $5 Series of 1934C narrow

faces when mated with micro back plate

637 produced exotic mules. The face

plate on this one is 2031, the last of the

four narrow 1934C faces. Figure 4b

(below) closeup.

Figure 5 below. Comparison between

the wide and narrow $5 Federal Reserve

faces showing how the spiral was tight-

ened up on the narrow. The means used

to shorten the lower border on the FRNs

was different from the SCs and LTs.

Contrast this with Figure 3 (shown again

below left for comparison)

Wide

Narrow

330 September/October • Whole No. 245 • Paper Money

SC

LT

FRN

The differences can be seen on Figure 6 in the comparisons between the nar-

row SC and LT engravings, and those of the narrow FRN.

The shortening across the top border of the FRNs was handled identical-

ly to the SC and LT notes. See Figure 7.

Data on Table 1 reveal that the FRN die was finished in April 1948, a

month and a half before the SC die. It was used to make a 12-subject master

that was begun November 1, 1948. However, the first production plate wasn't

duplicated from the master until April 1949.

The image first appeared on the last six of the Series of 1934C face plates

made for New York, specifically plates 298 to 303, begun in April 1949. Data

for these important plates are summarized on Table 4. They comprised an

unusually late order for Series of 1934C FRN face plates. The previous New

York $5 Series of 1934C face was wide 297 certified June 2, 1947, almost two

years earlier.

The six New York plates turned out to be the last in the $5 1934C FRN

series. Consequently, usage of the narrow design for the other districts was

delayed until production of the 1934D plates beginning in August.

Fifty-one $5 Series of 1934C New York face plates were used, specifically

plates 253-289, 291-303. Thus, the six narrows represent about 12 percent of

New York 1934C production. Narrow New York faces will prove to be far

Figure 6 (above). Compare the differ-

ent appearance of the spirals used on

the SC and LT notes, and those on the

FRN notes. Notice how the spiral on

the FRN has a distinctive internal

shape and is bolder in appearance.

Figure 7 (right). Comparisons

between the upper right corners of

the wide and narrow $5s. The short-

ening was the same regardless of

class.

SC

LT

FRN

Wide

Narrow

Wide

Narrow

ifolittatAliStoth •

TNISMOnNU.S.krINDIFPORAtIUKOINO.

FUSIICAAOPMVATIANOIRRIOLI.MAIMIX „

OPA7AMVADERAt*ESVOithARK

0.1,0t.VOTIV .01110 TTTTT .11/10...Unt

1.1411CO Or IP2• C

VASIIINGTON.D.C.

IlValr.I.1..).11: '11'4) 'MIME SWICALIIIIMIIII 011011, D n'111.11.711 , 11•

1171111VILD 11111111MALALWIlletIO

Paper Money • September/October 2006 • Whole No. 245 331

Table 4. Comprehensive data for the six $5 Series of 1934C New York Federal Reserve narrow face plates. Plates 298-

303 were the last $5 Series of 1934C Federal Reserve face plates made for any district.

Plate Begun Certified Reentered Recertified Canceled Logged Out

to Press Room

Last Series of 1934C wide face plate:

297 May 9, 1947 Jun 2, 1947 Oct 11, 1949 Nov 15, 1951 Sep 20, 1949-Oct 10, 1949

Series of 1934C narrow face plates:

master Nov 1, 1948 Apr 21, 1950

298 Apr 12, 1949 May 6, 1949 Nov 15, 1951 May 13, 1949-May 17, 1949

Dec 5, 1949-Dec 7, 1949

Feb 20, 1950-Feb 27, 1950

299 Apr 12, 1949 May 13, 1949 Nov 15, 1951 Jul 27, 1949-Aug 25, 1949

Dec 5, 1949-Dec 7, 1949

Feb 13, 1950-Feb 27, 1950

300 Apr 14, 1949 May 6, 1949 Nov 15, 1951 May 13, 1949-May 17, 1949

Dec 5, 1949-Dec 7, 1949

Feb 13, 1950-Feb 27, 1950

301 Apr 14, 1949 May 6, 1949 Nov 15, 1951 May 13, 1949-May 17, 1949

Dec 5, 1949-Dec 7, 1949

Feb 13, 1950-Feb 27, 1950

302 Apr 18, 1949 May 18, 1949 Feb 21, 1950 Nov 15, 1951 Jul 27, 1949-Oct 10, 1949

Dec 5, 1949-Dec 7, 1949

Feb 13, 1950-Feb 20, 1950

303 Apr 18, 1949 May 6, 1949 held for

exhibit or

modeling

May 13, 1949-May 17, 1949

Dec 5, 1949-Dec 7, 1949

Feb 8, 1950-Feb 27, 1950

First Series of 1934D narrow face plates:

304 no data Aug 9, 1949

rarer than SC 1934C narrows because far fewer were made. They were made

though, and can be found through diligence and a bit of luck. They occur in

the BC block, and possibly the B*. See Figure 8.

Figure 8. Specimen from one of the six

Series of 1934C New York FRN face

plates. This note, from the BC block, is

from plate 303, the last in the series.

New York was the only district to uti-

lize narrow 1934C face plates.

Use of the narrow Series 1934C New York faces overlapped the last pro-

duction from micro back 637, the same as with the SC 1934Cs. Consequently

637 mules are possible, most likely mated with faces 298, 300, 301 and 303,

which were on the presses at the same time. If they were produced, they will

occur on the BC block and possibly the B*.

The $5 Series of 1934C 637 mules have proven to be rare regardless of

district. Only six from the BC block have been reported, but no stars. None of

the six 1934C BC block 637 mules have narrow faces. Narrow Series of 1934C

637 mule FRNs will prove to be stellar rarities if ever found!

September/October • Whole No. 245 • Paper Money332

$10 FRN Faces

The first narrow $10 face plate was certified in August

1949, a year after the narrow die had been completed. As

shown on Figure 9, the horizontal dimension of the face was

shortened by slightly trimming off the right and left ends. The

best place to look for differences is adjacent to the floral S

under the 10 in the upper right counter. One prominent white

line in the background passes through the gap between the

lower loop of the S and the border on the wide, whereas it is

missing on the narrow.

This modification was accomplished early in the resizing

program before the end of the Series of 1934C. Only one late

order, consisting of four Series of 1934C plates for the Kansas

City Federal Bank, was made using the narrow design. This is

a virtual repeat of the $5 1934C narrow faces for New York.

The memorable narrow numbers are $10 Series of

1934C Kansas City faces 86, 87, 88 and 89. The data for them

are reproduced on Table 5.

The wide Kansas City $10 Series of 1934C faces were

numbered 63 to 85. Of these, 77, 79, 82 and 83 were never

used.

The use of the narrow plates was most interesting. An

highly unusual notation in the plate history ledger reveals that

all four of the plates were sent to the press room as a set on

December 7, 1949. Obviously they were to be used together

on one four-plate press, instead of being mixed in with the

other available Kansas City $10 faces plates.

As it turned out, they were the only Kansas City $10

plates in use at the time. They kicked off a press run that ran

from December 7, 1949, to January 10, 1950. However, plate

87 went bad the first day, and was replaced by wide 85. Wide 85 lasted until

December 21st, when it was in turn replaced by 80 to complete the run.

Plate 86 showed wear by January 29th, so was replaced by wide 63.

Similarly, 88 and 89 were cycled out on January 4th and replaced by wides 64

and 65. Ironically, none of the four narrows made it to the end of the press

run.

The paramount fact is that $10 Series of 1934C narrow faces were pro-

Figure 9. Comparison between the wide

and narrow $10 Federal Reserve faces

showing the degree of horizontal short-

ening. Kansas City was the only district

to utilize narrow 1934C face plates, and

only four were made.

Wide

Narrow

Wide

Table 5. Comprehensive data for the four $10 Series of 1934C Kansas City Federal Reserve narrow face plates. Plates

86-89 were the last $10 Series of 1934C Federal Reserve face plates made for any district. The ledger shows that they

were sent to the press room as a set.

Plate Begun Finished Reentered Recertified Canceled Logged Out

to Press Room

Last Series of 1934C wide face plate:

85 Oct 3, 1947 Nov 28, 1947 Dec 22, 1949 Nov 15, 1951 Dec 7, 1949-Dec 21, 1949

Series of 1934C narrow face plates:

86 Mar 30, 1949 Apr 18, 1949 Dec 30, 1949 Nov 15, 1951 Dec 7, 1949-Dec 29, 1949

87 Mar 30, 1949 Jun 3, 1949 Dec 9, 1949 Nov 15, 1951 Dec 7, 1949-Dec 8, 1949

88 Mar 30, 1949 Jun 7, 1949 Jan 5, 1950 Nov 15, 1951 Dec 7, 1949-Jan 4, 1950

89 Mar 5, 1949 May 5, 1949 Jan 5, 1950 held for

exhibit or

modeling

Dec 7, 1949-Jan 4, 1950

First Series of 1934D narrow face plate:

90 Nov 8, 1949

Paper Money • September/October 2006 • Whole No. 245

333

Today discoveries await lucky collectors

Wide

Narrow

Figure 9A. First reported wide to narrow changeover pair of $10 FRN Series of 1934C Kansas City notes, a pair put together by

James Hodgson.

Buying & Selling

All Choice to Gem CU Fractional Currency

Paying Over Bid

Please Call:

314-878-3564

ROB'S COINS & CURRENCY

P.O. Box 6099

St. Louis, MO 63017

Figure 10 (above). Comparison between the wide and nar-

row $10 Silver Certificate faces showing the degree of hori-

zontal shortening. The oval highlights a distinctive back-

ground feature in the border that is missing on the narrow

variety.

Wide

Narrow

Wide

Wide

Narrow

Wide

Narrow

September/October • Whole No. 245 • Paper Money

duced for the Kansas City district. There weren't a lot of

them.

They occur on the JA block, and possibly the J*, the

only $10 blocks used by Kansas City on Series of 1934C

notes. The discovery note is J73832613A B88/1237.

The wide to narrow transition on the $10 backs

occurred in February 1952, long after printings of the FRN

1934 series had ceased. Consequently there is no possibility

for a $10 1934C narrow back. Similarly there are no 1934D

narrow backs either.

$10 Silver Certificate Faces

The first narrow $10 Silver Certificate face plate came

along on February 10, 1950, almost six months after the nar-

row $10 FRN faces. The changes on the SC die were identi-

cal to those made to shorten the horizontal dimension of the

$10 FRN face. See Figure 10.

The $10 wide to narrow SC changeover occurred

between the Series of 1934C and D plates. The changeover

plates were 1934C 232 and 1934D 233. Thus there were no

rarities created by a changeover within either series.

There is, however, an interplay between the wide and

narrow $10 back designs, and the Silver Certificate face vari-

eties. The first narrow $10 backs were printed February 14,

1952. Printings from them post-dated the last use of the

1934C SC faces by a year and a half. Consequently there is

no possibility of a narrow back 1934C note. However, there

are both wide and narrow back 1934D notes, a fact known for

decades thanks to the pioneering work of Goodman, Schwartz

and O'Donnell.

$20 FRN Faces

As shown on Figure 11, horizontal shortening on the

$20 FRN face was accomplished by trimming off the ends.

However, this put a serious squeeze on the scroll that largely

defines both ends of the design. In order to accommodate the

required shortening, it was also necessary to tighten up the

scrolls by re-engraving them. This involved no small amount

of work.

The $20 FRN face die was completed in February 1949,

and could have been used to make Series of 1934C faces.

However, it wasn't needed until October because the demand

for $20 faces was small. Consequently the changeover from

wide to narrow was made between the Series of 1934C and

1934D plates for all the districts. No rarities were created.

$50 FRN Faces

BEP records reveal that a narrow $50 FRN face die was

completed August 23, 1949. The first plate made from it was

the first $50 Series of 1934D for Boston which was certified

March 27, 1950. The changeover for all twelve districts

occurred between the 1934C and D notes as with the $20 and

$100 faces.

Figure 11 (left). Comparison between the wide and narrow $20 Federal

Reserve faces showing the degree of horizontal shortening. Notice how

the scroll was tightened up on the narrow variety.

334

Paper Money • September/October 2006 • Whole No. 245

335

OUR MEMBERS SPECIALIZE IN

SMALL SIZE CURRENCY

They also specialize in Large Size Type Notes, National Currency,

Colonial and Continental Currency, Fractionals, Obsolete Notes,

Error Notes, MPC's, Confederate Currency, Encased Postage,

Stocks and Bonds, Autographs and Documents, World Paper Money...

and numerous other areas.

THE PROFESSIONAL CURRENCY DEALERS ASSOCIATION

is the leading organization of OVER 100 DEALERS in Currency,

Stocks and Bonds, Fiscal Documents and related paper items.

PCDA

• Hosts the annual National and World Paper Money Convention each fall in St. Louis, Missouri.

This year's show will be held Nov. 16-18, 2006 at the St. Louis Airport Hilton Hotel.

• Encourages public awareness and education regarding the hobby of Paper Money Collecting.

• Sponsors the John Hickman National Currency Exhibit Award each June at the Memphis Paper

Money Convention, as well as Paper Money classes at the A.N.A.'s Summer Seminar series.

• Publishes several "How to Collect" booklets regarding currency and related paper items. Availability

of these booklets can be found in the Membership Directory.

• Is a proud supporter of the Society of Paper Money Collectors.

[ )

To be assured of knowledgeable, professional, and ethical dealings

when buying or selling currency, look for dealers who

proudly display the PCDA emblem.

The Professional Currency Dealers Association

For a FREE copy of the PCDA Membership Directory listing names, addresses and specialties

of all members, send your request to:

PCDA

James A. Simek — Secretary

P.O. Box 7157 • Westchester, IL 60154

(630) 889-8207 • FAX (630) 889-1130

Or Visit Our Web Site At: www.pcdaonline.com

336 September/October • Whole No. 245 • Paper Money

It is unclear from the die card which dimension was shortened, but it

probably was the horizontal. Whatever they did was so sophisticated or slight,

we cannot detect the difference! Maybe you can. If so, kindly advise.

$100 FRN Faces

The wide to narrow transition on the $100 faces occurred between the

1934C and D plates for all districts. The narrow $100 face die was completed

in February 1950, but not used until June well after the Series of 1934D had

begun. No rarities were created as a result of the change.

The job of shortening the horizontal dimension was accomplished rather

imaginatively in an effort to minimize re-engraving. The entire right and left

borders, inclusive of the counters in the corners and the floral design work that

connects them, were detached wholesale and slid inward.

Figure 12 shows the degree of shortening between the wide and narrow

varieties. Figure 13 shows where the border design was overrun in order to

shorten the horizontal dimensions of the design.

Wide

Narrow

Figure 12 (above). Comparison

between the wide and narrow $100

Federal Reserve faces showing the

degree of horizontal shortening.

Figure 13. The ovals show where the

borders were trimmed in order to nar-

row the width of the $100 face design.

Wide Narrow

Paper Money • September/October 2006 • Whole No. 245

$1 Backs

The first backs to be resized were the $1s. The narrow die was complet-

ed in May 1949, and the first plate in September. The vertical dimension was

shortened, thus becoming the only case of vertical shortening in the resizing,

program. The slack was taken up

by trimming- the top and bottom

borders as shown on Figure 14.

The change occurred dur-

ing production of 12-subject $1

Series of 1935D Silver

Certificates. The changeover

plates were 5015 and 5017. Data

on Table 6 reveal that wide

backs continued to be used into

March 1953, three and a half

years after the narrow design was

adopted.

337

Figure 14. The $1 back was the only

design that needed to be shortened in

the vertical direction. This was done by

trimming the top and bottom borders.

Table 6. Key plates and dates associated with the changeovers between the 12-subject wide and narrow back designs.

Changeovers are arranged in chronological order of the earliest certification of a plate with the new design. All plates treat-

ed here except $5 back 2097 were 12-subject plates.

The plate having the lowest number for a given variety usually was not the first plate with the variety to be certified or

used. Conversely, the plate having the highest number for a given variety usually was not the last plate with the variety to

be certified or used.

Last Last Date Last Date First First Date First Date

Wide a Wide a Wide Narrow a Narrow a Narrow

Plate Plate was Plate was Plate Plate was Plate was

Number Certified Used Number Certified Used

$1 wide to narrow transition:

5015 Aug 10, 1949 Mar 19, 1953 5017 Sep 22, 1949 Sep 28, 1949

$20 wide to narrow transition:

669 Jun 17, 1949 Aug 8, 1950 670 Jul 3, 1950 Jul 11, 1950

$5 wide to narrow transition:

2006 May 2, 1951 Sep 2, 1953 2007 Nov 7, 1951 Apr 7, 1952

$10 wide to narrow transition:

1389 May 4, 1951 May 26, 1953 1390 Dec 20, 1951 Feb 14, 1952

Last Last Date Last Date First First Date First Date

Narrow a Narrow a Narrow Wide II a Wide II a Wide II

Plate Plate was Plate was Plate Plate was Plate was

Number Certified Used Number Certified Used

$5 narrow to wide II transition:

2066 Feb 26, 1952 Sep 3, 1953 2067 Apr 15, 1952 Oct 24, 1952

First Date First Date

Last Last Date Last Date First a Narrow a Narrow

Wide II a Wide II a Wide II Narrow 18-Subject 18-Subject

Plate Plate was Plate was Plate Plate was Plate was

Number Certified Used Number Certified Used

$5 wide II to 18-subject narrow transition:

2096 Jun 2, 1952 Sep 2, 1953 2097 Mar 31, 1953 Apr 3, 1953

Figure 15. Comparison between the

wide and narrow $5 backs showing the

degree of horizontal shortening. The

floral spiral next to the counter was

tightened to do the job.

Figure 16. The easiest way to distinguish

between the two $5 back varieties is to count

the number of pairs of vertical lines to the right

of the tip of the line that defines the center of

the spiral.

Wide

Narrow

Wide

Narrow

338 September/October • Whole No. 245 • Paper Money

There was ample opportunity for changeover pairs between the varieties

because both wide and narrow plates were used together on the same press for

so long. Dual use spanned 20 blocks. Included were 12-subject printings in

1935D blocks UE through MG, and *B and *C, but not GG. The GG block

was used exclusively for early 18-subject production, so all had narrow backs.

$5 Backs

The $5 backs always have been special to collectors because things were

complicated. A group of narrow plates was made, but then they were followed

by a throwback group of wides. No explanation has been found for this anom-

aly, but collecting the groups gives variety specialists a good chase, and some

rarities were created as well.

The shortening across the narrow backs was accomplished in a manner

similar to the faces. Figure 15 shows the degree of shortening, whereas

Figure 16 shows where to look for the most definitive differences.

One characteristic of high volume plates, such as the $5s, is that they are

manufactured on a rather continuous basis. However, there was a seven-month

hiatus before the startup of the narrow plates. The break in the routine indi-

cates that change was in the works. Similarly, there was a two and a half month

hiatus before the second group of narrow plates was begun.

The changeover between the wide and narrow $5 backs occurred

between plates 2006 and 2007, respectively begun March 16, 1951, and

October 10, 1951. The modification involved a horizontal shortening of the

design.

The last wide plate in the pre-2007 range remained in service until

September 2, 1953, right to the end of 12-subject usage. See Table 6.

Plates 2007 through 2066 were narrow. They were used from April 7,

1952 to September 3, 1953.

Plates 2067 through 2096 were finished as wides, long ago named Wide

II by Goodman, Schwartz and O'Donnell. The changeover plates, 2066 and

2067, were begun respectively January 7, 1952, and March 20, 1952. The

Wide II plates were used from October 24, 1952, to September 2, 1953.

The narrow design was re-instituted on all the 18-subject plates that fol-

lowed, beginning with 2097. The 18-subject narrow 2097 was begun October

1, 1952, finished March 31, 1953, and placed in service April 30, 1953. A cou-

ple of other 18-subject plates beat it into production on April 3rd. Both 12-

and 18-subject backs were being made for five months during the transition to

18-subject presses in mid-1953.

All three of the 12-subject groups - Wide I, narrow and Wide II - were

Paper Money • September/October 2006 • Whole No. 245 339

used on 1934D Silver Certificates, 1928F Legal Tender Notes and 1950

Federal Reserve Notes. The available varieties, especially in the Federal

Reserve Notes, are endless. All Wide II star notes in the 1950 Federal Reserve

and 1928F Legal Tender issues are rare.

The plates from all three groups were on the presses together until

September 2-3, 1953, whenl2-subject $5 back production ceased. The result is

ample opportunity for all sorts of exotic changeover pairs between the three.

$10 Backs

The first narrow $10 back plate was certified May 4, 1951.

The narrows involved a horizontal shortening as shown on

Figure 17, taken up by trimming the borders on both ends.

The narrow variety appeared on the $10 1934D Silver

Certificates and 1950 Federal Reserve Notes. Narrow back

1934D Silver Certificates are quite scarce, with the stars being

rarities. Narrow back stars in the 1950 Federal Reserve Notes

are tough, and some districts are going to prove to be very scarce

to rare when the last word is in.

$10 wide and narrow back plate usage overlapped from February 1952,

until May 1953, so changeover pairs between them were printed in both the

Silver Certificate and Federal Reserve Note series. Such changeover pairs have

proven to be very scarce because packs of $10s of that vintage were not saved

very often.

$20 Backs

The second backs to undergo resizing were the $20s which were short-

ened in 1950 in the horizontal dimension as shown on Figure 18. The prima-

ry diagnostic feature involves the floral design in the embellishment below the

plate number. As shown on Figure 19, it is more tightly rolled on the narrow

Figure 17. Comparison between the

wide and narrow $10 backs showing

the degree of horizontal shortening.

Shortening was easily accomplished by

trimming both ends.

Wide

Narrow

Figure 18 (below left). Comparison

between the wide and narrow $20

backs showing the degree of horizontal

shortening. The slack was taken up by

tightening up the folds in the banner to

the left of the counter, and allowing

the counter to overrun the border

above the banner.

Wide

Narrow

design which allowed the

designers to slide the right

border and counters in the

corners toward the center of

the note. This change is

mirrored on the left side as

well.

The changeover from

wide to narrow occurred dur-

ing production of $20 Series

of 1934D Federal Reserve

Notes. The last $20 wide

back plate was 669; the first

narrow, 670. The last certifi-

cation date for a $20 wide

production plate was June

17, 1949; the first for a nar-

row July 3, 1950.

Figure 19 (bottom). The easiest place

to see the difference between the wide

and narrow $20 backs is in the floral

design below the plate number. The

"budding leaf" has not opened as far

on the narrow design so it touches the

"stalk" to the left.

Wide

Narrow

340 September/October • Whole No. 245 • Paper Money

The last date that a wide $20 was on the presses was August 8, 1950;

however, the first narrow went to press July 11th. Consequently wide and nar-

row plates were on the presses concurrently for almost a month so changeover

pairs between the two types should exist, but will prove to be scarce.

It is theoretically but remotely possible that some $20 Series of 1950 faces

were printed on wide backs. Deliveries of Series of 1950 notes began in

November 1950 for Atlanta, just a few months after the last wide back plates

went out of service. A stockpile of wide backs would have had to have been

available in order for them to have been mated with the Atlanta or later Series

of 1950 face press runs. However, we currently have no evidence that stockpil-

ing of that duration was occurring at the time.

Conversely, the action just may be in the Series of 1934C. That is, some

$20 Series of 1934C faces may have been mated with narrow backs.

There are two tantalizing entries in the plate history ledgers to this effect.

Series of 1934C Chicago face plate 122 and St. Louis face 61 were sent to press

from May 22, 1951, to May 28, 1951. This week-long period was well within

the narrow era so if there were production from those faces, it would have cre-

ated Series of 1934C narrow $20s for the two districts.

A caveat is in order. "Sent to press" in the plate history ledgers doesn't

always mean on the press. What "sent to press" means is that the plates were

checked out to the press room from the plate vault. Generally they were used,

but some simply were held in the press room as backups.

It appears in these two cases that the then obsolete 1934C plates were

used either to meet short term spikes in production or as temporarily available

backup plates within the press room. Quite likely is the possibility that they

were used alone on separate presses to print stocks for small star note runs.

Consequently our preferred choice for searching for possible $20 1934C nar-

rows is to look at the backs of Series of 1934C G* and H* notes. If any are ever

found, they will be rarities.

What about $50 and $100 Backs?

No $50 and $100 narrow back dies were made as part of the wide to nar-

row transition program. The last 12-subject $50 and $100 back plates were

166 and 132, respectively certified August 8, 1944, and July 28, 1944. Stocks

of them were more than sufficient to last to the end of the 12-subject era. No

more were made until July 9, 1953, with the advent of the18-subject plates.

How Designs Were Resized

The resizings necessarily involved making new master dies. All the

designs that were altered were shortened in the horizontal dimension except

for the $1 back which was shorted from top to bottom.

What follows is a scenario that could have been used to slightly shorten

the horizontal dimension on a note such as the $100 face in order to create a

narrower design. The same concept works for simpler designs such as the $2

and $10 faces where all that was needed was to trim off the ends.

It is likely that three images were transferred to a roll from the original

master die. This was accomplished by rocking the roll -- a soft steel cylinder --

back and forth over the hardened flat steel die until the desired part of the

image was transferred to the roll.

The largest transfer consisted of the central part of the design complete

except for the right and left borders. The other two were the right and left

borders. Undesired parts of the images inadvertently picked up on the roll

were carefully ground off, as were the parts of the central image removed from

the right and left ends to shorten the design. The roll was then hardened by

heating and quenching.

The shortened central image could then be laid in on a new soft master

die using the same transfer technology. Next the borders could be transferred

into place slightly inward from their former positions on the old master die.

'IPMG• - •$5021,,9921,i,l,vleirwCrke:tificate

rtm mo , ry GI ,u,' SiN N158431409 pp A

/I'LL:Wilt. 'L

Cam"

-

M58433409:-

M58433409:

itymi•itttuqrtirpttin,Xa IlEr.2[111711ED vt4ttuttvg.vrotf.4.

Paper Money • September/October 2006 • Whole No. 245 341

TRUST YOUR TREASURES TO THE INDUSTRY'S

)REFERRED Fi .)LDE

Label Features Preservation. Identification. Appreciation.

Your notes deserve the best. That's why PMG developed this holder—combining

the qualities that collectors value most. The PMG holder...

...Is made from the highest-quality, inert materials. It contains no openings or

perforations—guarding against environmental hazards and contaminants.

...Features a large label that displays precise and specific information about your note,

including a full attribution, pedigree, and graders' comments, as applicable.

...Accommodates a wide range of currency albums. Your notes take center stage with

protective materials that maximize superior visibility.

PMG's primary commitment is to provide accurate and consistent grading of paper

money—to impart confidence and reliability. This also includes understanding what

numismatists want from a holder. And that's why we are bringing a new standard of

impartiality and integrity.

To learn more about PMG, visit wwvv.PMGnotes.com , or contact Glen Jorde,

Grading Finalizer, at 877-PMG-5570.

Join the . ciAPMGcommunity

oovoccollectors-society cog PAPER MONEY GUARANTY

P.O. Box 4755 I Sarasota, FL 34230 877-PMG-5570 (764-5570) I www.PMGnotes.com

An Independent Member of the Certified Collectibles Group

Prominent display of

cataloging information

and grade

Security features such as

hologram, bar code, and

reiterated grade

Generous area for

graders' comments

September/October • Whole No. 245 • Paper Money342

Figure 11 (shown again). Comparison

between the wide and narrow $20

Federal Reserve faces showing the

degree of horizontal shortening. Notice

how the scroll was tightened up on the

narrow variety.

Finally, if necessary, an engraver retooled the region of the splices to merge the

parts. The new master die was hardened upon completion.

More difficult were designs that didn't lend themselves to simple cut and

paste fixes. The $20 face is a good example. Notice on Figure 11 how the

scroll in the center of the border was tightened up on the narrow to accommo-

date the shortening. This involved re-engraving parts of the scrolls on both

ends. Similarly, the $5 faces and backs illustrate situations where the accom-

modation required re-engraving parts of flourishes adjacent to the counters in

the lower corners.

Present Status

The $5 narrow and Wide II backs, as well as $10

narrow backs, have been known for decades. Yet the

prices in catalogues poorly represent the true rarity of

many notes with these varieties. Now we have more of

them to contend with!

The considerable cataloging task remains to learn

of, and catalog, the narrow varieties by class, denomina-

tion and serial number block letters. This will be espe-

cially daunting in the Federal Reserve series.

For example, we have a very poor handle on the

$20 narrow back Federal Reserve Notes. Some exotic

$20s probably await discovery such as narrow back

1934C and 1950 notes. Some of the $20 1934D narrow

back stars are going to prove to be great rarities as well.

A particularly fertile area for discovery and serious

variety collecting involves changeover pairs between the

varieties. Changeover pairs were created because the

flat bed presses in use at the time held up to four plates

which circulated around the bed of the press. A stream

of sheets came off a given press which cycled through

the plates present. Wide and narrow plates typically

were mixed on a press. Consequently the sheets in the

finished stack cycled through the varieties.

The sheets were next cut in half vertically, and the

6-subject half sheets were fed through serial numbering

and separating machines. The notes were numbered

consecutively from top to bottom on the half sheets,

and then from half sheet to half sheet. The result was

either wide to narrow, or narrow to wide, changeover

pairs as numbering passed from one half sheet to the next.

Things got particularly complex when wide and narrow plates were in

concurrent use on both the back and face presses!

Just about every transition treated here involved the production of

changeover pairs. Historically, the recognized wide to narrow back changeover

pairs have not received as much attention from collectors or catalogers as has

been lavished on signature changeover pairs. In fact, they have received less

attention than non-mule to mule, or late-finished to regular, changeover pairs.

The fact is, very few wide to narrow changeover pairs have been documented

outside of the $1 backs. Most possibilities haven't even been discovered yet.

Some extraordinary combinations are awaiting discovery.

Imagine discovering any one of the several possible changeover combina-

tions involving $5 Silver Certificate Series of 1934C 637 mules and narrow

faces. Each combination would classify as an exotic. Even more spectacular

would be such a pair with star serials!

Wide

Narrow

Wide

Narrow

X

.18

.12

.09

.075

.065

.0575

.049

Paper Money • September/October 2006 • Whole No. 245 343

Sources of Data

Bureau of Engraving and Printing, various dates, Certified proofs from small size cur-

rency plates. National Numismatic Collections, Museum of American History,

Smithsonian Institution, Washington, DC.

Bureau of Engraving and Printing, various dates, Ledgers and historical record of print-

ing plates. Record Group 318, U. S. National Archives, College Park, MD.

Goodman, Leon J., Schwartz, John L, and O'Donnell, Chuck. Standard Handbook of

Modern U. S. Paper Money. Printed by Fleetwood Letter Service, 1968, 54 p.

Oakes, Dean, and Schwartz, John. Standard Guide to Small-Size U. S. Paper Money, 1928

to Date, 2nd edition. Iola,WI: Krause Publications, 1997, 339 p.

Acknowledgments

Cecilia Wertheimer and Eric Woodward of the Bureau of Engraving and

Printing Historical Research Center located and provided copies of the narrow die

cards. James Hughes provided access to the certified proofs in the National

Numismatic Collection at the Smithsonian Institution. This research was sponsored by

the Society of Paper Money Collectors and the Professional Currency Dealers

Association.

Letter to

the Editor

Dear Mr. Reed, my name is David T. Lloyd, son of Bob Lloyd. I received your magazines with a fabulous article

aboout my dad. Bob age 100 and Gladys age 102 now live with my sister Martha in New York. My wife and I just

returned from visiting there. Dad is getting weak, very frail. Tires early, but for age 100 he is great. Good mind,

but has trouble remembering. Thank you for being a good friend of my dad. Sincerely, David T. Lloyd. Readers

who wish to brighten Bob Lloyd's day can send him a note or card at 285 Athens Blvd., Buffalo, NY 14223-1603 -- Editor v

Mini-dollar: Shrinking Value of the ILS,Dollar

By Leslie Deerderf

Shawn Hewitt is employed, also provides a web-based calcula-

tor (http://minneapolisfed.org/research/data/us/calc/) more

positively named "What is a dollar worth?" It allows you to

calculate comparisons of various years. So for example, our

1913 saddle blanket dollar had already shrunk to 58 cents by

the time the U.S. converted to small size notes! According to

the Federal Reserve Bank of San Francisco "currency was

Value of Small Size Currency in terms of CPI since 1913

TT'S WIDELY KNOWN THAT INFLATION HAS

ireduced the purchasing power of the once "Almighty

American Dollar." In fact, souvenir stands will sell you a

"shrunken dollar" that is about the size of a postage stamp.

Thirty years ago I did an exhibit at a local coin show to

dramatize this erosion of value. At the time our dollar was

"worth" about 20 cents compared to a base year. I used 1913

which is when the Federal Reserve Act x

was passed and the Fed took over con-

trol of the nation's monetary policy.

In today's global age, where for-

eigners and foreign governments

increasingly own our cash, I thought I'd

look into what has transpired over the

past three decades. The web has any

number of "currency calculators." I

like the one at factmonster.com

(http://www.factmonster.com/ipka/

A0001519.html) because it is simple.

"The Shrinking Value of the Dollar" 1913 1920 1928 1935

there provided data on which my chart above was calculated.

Coincidentally, factmonster's gauge is based on the

Consumer Price Index inflation calculator which also happens

to date to 1913 when it was invented, so it is in sync with other

analyses like mine which peg to the Fed created the same year.

"This data represents changes in prices of all goods and

services purchased for consumption by urban households... In

2002, for example, it took $17.89 to buy what $1 bought in

1913. Note that in 1920, it cost $2.02, and declined in 1925

and through the 1930s, illustrating the effect of the Great

Depression, when prices slumped. Prices did not pass $2

again until 1950," Factmonster reports.

The Minneapolis Fed Bank, where SPMC member

x

x x

1945 1955 1965 1975 1985 1995 2006 2015

reduced in size by twenty-five percent," but actually large size

are 7.5" by 3.125" (23.4375 square inches) and small size are

6.125" by 2.625" (16.078125 square inches) so my calculator

tells me it was really 31.4%. Since the notes' purchasing

power by that time had shrunk 42%, I guess the new small

sized notes were close enough to their actual value for govern-

ment work! If the Treasury had continued to reduce our notes

in parallel to their deflated value, today's FRNs would be

about 1.35 square inches (1.8 inches wide by 3/4 of an inch

high), an apt size for a note now worth less than a nickel.

No wonder goods I might have purchased with my 1975

dollar would theoretically cost me $3.76 today. Can you say

"Holy, gas prices, Batman!"?

1913 $1.00 1940 .71 1975

1915 .98 1945 .55 1980

1920 .495 1950 .41 1985

1925 .565 1955 .37 1990

1928 .58 1960 .33 1995

1930 .59 1965 .31 2000

1935 .72 1970 .255 2006

A00008571/1

WAsillNares.1).C.

z MLLE 10021311 NITWISINEICALc vowarmar, oe•Als't= 417■ ,ii=aufer oxar' .1M-441■47■1

IUM114, 11=“111.1 10;

344 September/October • Whole No. 245 • Paper Money

Lucky Day Discovery

An Elusive 1928

$1000 Boston Federal Reserve Note

By Donald Noss Jr. CPA

I RECEIVED A PHONE CALL IN LATE JANUARY

2006 from an individual living along the Gulf Coast. He

knew I collected currency and wrote some articles for a few

publications so he correctly thought I would be interested in

what happened to him on his day off from work.

Of course, he was right!

His day started out about the same as most others.

Nothing in particular happened in the morning. But things

were to change around noon. That's when lie just happened

to be at the right place at the right time to see someone slowly

open an old oversized tarnished envelope that had probably

not seen the light of day for over 50 years.

Time stood still for a few

moments as he waited for the

owner's hand to slowly remove the

contents from the envelope. Out

came another old-looking envelope,

but in better condition. Then, slow-

ly and carefully, this inner envelope

was opened to reveal a beautiful One

Thousand Dollar bill.

Well, he tried to hide his sur-

prise and think of something to say

other than "Wowowow!" He did

not collect currency, but his intuition

told him he should buy this note.

He can't remember exactly what he

said, but after sonic back and forth

banter, he told me he was able to purchase this $1000 bill for

exactly one thousand dollars within a few minutes of setting

his eyes upon it. He thought this could be his "Lucky Day."

He knew $1000 bills were still legal tender even though

never seen in ordinary day-to-day transactions. So, lie decided

to do a little research as soon as he deposited the bill in his

safety deposit box. After all, he hoped it was worth more than

the face value, a mere $1000 dollars.

It was a beautiful bill in every respect. It looked essen-

tially new and he did not want to bend or even breathe on it.

In fact, it was difficult to tell if it had ever seen the inside of a

wallet or pocket. Was there a fold in it or not? Hmmm. The

"Series of 1928" caught his attention. That seemed old.

And the golden obligation, "Redeemable in Gold,"

increased his heart rate a beat or two. However, it was the

word "Boston" printed inside the Federal Reserve Seal and

not the word "Gold" that made this note very rare.

And how valuable?

Well, who knows for sure until it goes up

someone offers a price that cannot be refused?

How many of these exist for this note cataloged as Fr.

2210-A? That source says 58,320 were printed, but it seems

not many exist today, perhaps only 6 or 7 of them. Catalog

values in the four figures are ridiculously low. The immense

Heritage Auctions data base lists no auction appearances of

one of these notes in their sales. In fact, it is possible that no

currency buyer has ever had the chance to buy one of these at

any auction. I'd appreciate knowing otherwise.

Large denomination bills are disappearing every day

into the portfolios of hard core currency collectors, and the

number of those individuals is increasing as you read this. I

expect this new discovery might find its way into a collector's

portfolio too, if the "Price Is Right." But the owner of this

rare little 1928 $1000 is not exactly in any hurry to dispose of

his fortuitous "New Find."

He knows it is quite rare and may be satisfied to watch it

grow in value while some serious investment money migrates

from coins to paper money. Demand from collectors for

these rare high-denomination bills continues to increase at the

same time some of these bills are actually being destroyed each

year by Federal Reserve Bank employees. That may be hard

to believe, but then again, that is supposedly their lawful duty

when these notes appear at the banks.

The owner intends to have this note graded to enhance

its potential value. So he ordered a $14 Plexiglas holder to

help guard this precious cargo in the mail. Given the rarity of

this note, that did not seem too extravagant an expense. After

all, when this article was written, there was a 1928 $1000

Boston note offered for sale on the Internet for $65,000.

The condition of that bill pales somewhat in compari-

son to this one. You know what they say "Condition,

Condition, Condition!"

If there's a moral to this story, let's just say keep your

eyes open and your antennae up.

for sale or

Paper Money • September/October 2006 • Whole No. 245 345