Please sign up as a member or login to view and search this journal.

Table of Contents

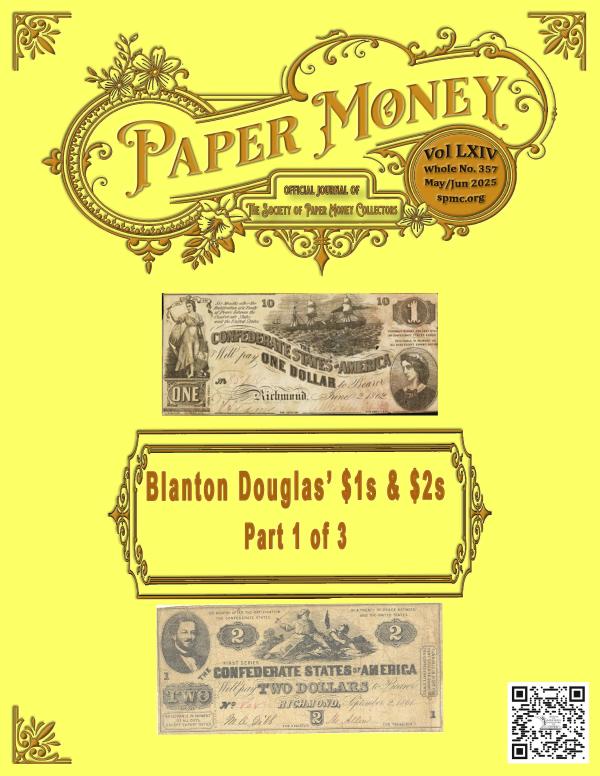

Blanton's 1s & 2s--Mark Coughlan

$10 18-Subject Wrong Plate Serial Numbers--Peter Huntoon

Panic of 1907--Matt Hansen, Lee Lofthus, Peter Huntoon

Portraits on Parade--Tony Chibbaro

Pin Money--Terry Bryan

Great Seal of the U.S. on Guatemalan Bank Notes--Roland Rollins

Astroria New York Post Office Robbed--Bob Laub

official journal of

Blanton Douglas’ $1s & $2s

Part 1 of 3

LEGENDARY COLLECTIONS | LEGENDARY RESULTS | A LEGENDARY AUCTION FIRM

Contact Our

Experts Today!

For More Information:

800.458.4646 CA • 800.566.2580 NY • Consign@StacksBowers.com

www.StacksBowers.com

America’s Oldest and Most Accomplished

Rare Coin AuctioneerNew York • California • Boston • Miami • Philadelphia • New Hampshire • Oklahoma

Sacramento • Virginia • Hong Kong • Copenhagen • Paris • Vancouver

SBG PM SummerGlobal25 HLs 250501

Summer 2025 Global Showcase

Auction Highlights from

STACK’S BOWERS GALLERIES

An Event Auctioneer Partner of the ANA World’s Fair of Money®

Auction: August 25-30 & September 2-5, 2025 • Costa Mesa, CA

Consign U.S. Currency by June 30, 2025

Peter A. Treglia

Director of Currency

PTreglia@StacksBowers.com

Tel: (949) 748-4828

Michael Moczalla

Currency Specialist

MMoczalla@StacksBowers.com

Tel: (949) 503-6244

1550 Scenic Avenue, Suite. 150, Costa Mesa, CA 92626

949.253.0916 • Info@StacksBowers.com

470 Park Avenue, New York, NY 10022

212.582.2580 • NYC@stacksbowers.com

Visit Us Online at StacksBowers.com

Fr. 1166b. 1863 $20 Gold Certificate.

PCGS Banknote About Uncirculated 50 Details.

Restoration.

Fr. 353. 1890 $2 Treasury Note.

PMG Gem Uncirculated 65 EPQ.

Fr. 1176. 1882 $20 Gold Certificate.

PMG Choice Uncirculated 64 EPQ.

Fr. 1205. 1882 $100 Gold Certificate.

PMG Very Fine 25.

Fr. 1220. 1922 $1000 Gold Certificate.

PMG Choice About Uncirculated 58 EPQ.

Fr. 1200mH. 1922 $50 Gold Certificate Star Note.

PMG Gem Uncirculated 66 EPQ.

135 Blanton's Ones & Twos--Part one--Mark Coughlan

146 $10 18-Subject Wrong Plate Serial Numbers--Peter Huntoon

152 Panic of 1907--Matt Hansen, Lee Lofthus & Peter Huntoon

168 Portraits on Parade--Tony Chibbaro

170 Pin Money--Terry Bryan

176 Great Seal of the U.S. on Guatemalan Bank Notes--Roland Rollins

186 Astoria, NY Post Office Robbed--Bob Laub

SPMC.org * Paper Money * May/June 2025 * Whole Number 357

129

Columns

Advertisers

SPMC Hall of Fame

The SPMC Hall of Fame recognizes and honors those individuals who

have made a lasting contribution to the society over the span of many years.

Charles Affleck

Walter Allan

Mark Anderson

Doug Ball

Hank Bieciuk

Joseph Boling

F.C.C. Boyd

Michael Crabb

Forrest Daniel

Martin Delger

William Donlon

Roger Durand

C. John Ferreri

Milt Friedberg

Robert Friedberg

Len Glazer

Nathan Gold

Nathan Goldstein

Albert Grinnell

James Haxby

John Herzog

Gene Hessler

John Hickman

William Higgins

Ruth Hill

Peter Huntoon

Brent Hughes

Glenn Jackson

Don Kelly

Lyn Knight Chet

Krause

Robert Medlar

Allen Mincho

Clifford Mishler

Barbara Mueller

Judith Murphy

Dean Oakes

Chuck O'Donnell

Roy Pennell

Albert Pick

Fred Reed

Matt Rothert

John Rowe III

From Your President

Editor Sez

New Members

Uncoupled

Small Notes

Cherry Picker Corner

Quartermaster

Obsolete Corner

131

132

133

172

179

180

183

190

Robert Vandevender

Benny Bolin

Frank Clark

Joe Boling & Fred Schwan

Jamie Yakes

Robert Calderman

Michael McNeil

Robert Gill

Stacks Bowers Galleries IFC

Pierre Fricke 129

Lyn Knight 144

PCGS-C 151

Higgins Museum 166

Executive Currency 167

F.C.C.B. 167

Greysheet 167

William Litt 167

Bob Laub 189

PCDA 193

Heritage Auctions OBC

Fred Schwan

Neil Shafer

Herb& Martha Schingoethe

Austin Sheheen, Jr.

Hugh Shull

Glenn Smedley

Raphael Thian

Daniel Valentine

Louis Van Belkum

George Wait

John & Nancy Wilson

D.C. Wismer

SPMC.org * Paper Money * May/June 2025 * Whole Number 357

130

Officers & Appointees

ELECTED OFFICERS

PRESIDENT Robert Vandevender II

rvpaperman@aol.com

VICE-PRES/SEC'Y Robert Calderman

gacoins@earthlink.net

TREASURER Robert Moon

robertmoon@aol.com

BOARD OF GOVERNORS

APPOINTEES

PUBLISHER-EDITOR ADVERTISING MANAGER

Benny Bolin smcbb@sbcglobal.net

Megan Reginnitter mreginnitter@iowafirm.com

LIBRARIAN

Jeff Brueggeman

MEMBERSHIP DIRECTOR

Frank Clark frank_clark@yahoo.com

IMMEDIATE PAST PRESIDENT

Shawn Hewitt

WISMER BOOk PROJECT COORDINATOR

Pierre Fricke

From Your President

Robert Vandevender IIFrom Your President

Shawn Hewitt

Paper Money * July/August 2020

6

jeff@actioncurrency.com

LEGAL COUNSEL

Robert Calderman gacoins@earthlink.com

Matt Drais stockpicker12@aol.com

Mark Drengson markd@step1software.com

Loren Gatch lgatch@uco.edu

Shawn Hewitt Shawn@north-trek.com

Derek Higgins derekhiggins219@gmail.com

Raiden Honaker raidenhonaker8@gmail.com

William Litt billitt@aol.com

Cody Regennitter

rman andrew.timmerman@aol.com

cody.regenitter@gmail.com

Andrew Timme

Wendell Wolka purduenut@aol.com

Nancy and I have had a busy couple of months. My job in California finally

came to an end the first week of April.

The last major numismatic event we attended in California was the Long

Beach Exposition which turned out to be the final one in 2025. The last two

Long Beach shows scheduled in 2025 are being canceled due to venue

problems. Nancy and I had to leave the Long Beach show a little early, so we

left the SPMC table set up with all of our displays and applications. I turned

over the case keys to VP Calderman who agreed to take down the display at

the end of the show when he was leaving. Mr. Calderman contacted me as he

was collecting our items and asked if I had removed everything from our cases

as both of them were gone. I replied to him “no” and then contacted show

staff regarding location of our cases. They confirmed they had collected the

full cases and found them. At my request, they sent the case contents to my

home in Florida by FedEx. I’m glad the cases on display weren’t cases full of

currency but only a few copies of Paper Money magazine and the SPMC

banner carrying case.

We spent several weeks arranging to get out of the apartment in San

Clemente and packing up our car with a laser printer, television, scanner and

other belongings. The fortunate thing about the timing of this long drive was

that it put us in Texas just before the start of the 4th Annual National Bank

Note Conference held at Heritage Auctions in Dallas. We spent a very

enjoyable two days with several of our collecting friends, many of whom

provided interesting presentations. The Heritage staff gave us a tour of their

facility where I had the opportunity to hold a 10-pound chunk of gold and a

moon rock. We also got to see clothing and several artifacts owned by General

George A Custer.

The Heritage staff treated everyone to a wonderful dinner at Via Real after

the first day of presentations. Day 2 of the conference was kicked off by

Duston Johnston of Heritage passing out an envelope to each table containing

copies of several large-size National Bank Notes. Each table “team” was then

tasked with arranging the notes on the table in order of their issuance. The

three of us in my group included Governor Derrick Higgins and Jamie Yates

so we did well on this exercise. The conference came to an end with everyone

being given a 20-question quiz on National Bank Notes, coordinated by

Heritage staff member Governor Raiden Honaker. I didn’t do as well on this

quiz as many others. Governor Cody Regennitter won the top prize by

scoring over 90% on the quiz.

Unfortunately, we will not be able to make it to the Central States show this

year. Our next major event will be the ANA World’s Fair of Money show in

Oklahoma City in August. I hope to see many of you there at our SPMC table.

SPMC.org * Paper Money * May/June 2025 * Whole Number 357

131

Terms and Conditions

The Society of Paper Money Collectors (SPMC) P.O. Box 7055,

Gainesville, GA 30504, publishes PAPER MONEY (USPS 00‐

3162) every other month beginning in January. Periodical

postage is paid at Hanover, PA. Postmaster send address

changes to Secretary Robert Calderman, Box 7055, Gainesville,

GA 30504. ©Society of Paper Money Collectors, Inc. 2020. All

rights reserved. Reproduction of any article in whole or part

without written approval is prohibited. Individual copies of this

issue of PAPER MONEY are available from the secretary for $8

postpaid. Send changes of address, inquiries concerning non ‐

delivery and requests for additional copies of this issue to

the secretary.

MANUSCRIPTS

Manuscripts not under consideration elsewhere and

publications for review should be sent to the editor. Accepted

manuscripts will be published as soon as possible, however

publication in a specific issue cannot be guaranteed. Opinions

expressed by authors do not necessarily reflect those of the

SPMC. Manuscripts should be submitted in WORD format via

email (smcbb@sbcglobal.net) or by sending memory stick/disk

to the editor. Scans should be grayscale or color JPEGs at

300 dpi. Color illustrations may be changed to grayscale at the

discretion of the editor. Do not send items of value.

Manuscripts are submitted with copyright release of the author

to the editor for duplication and printing as needed.

ADVERTISING

All advertising on space available basis. Copy/correspondence

should be sent to editor.

All advertising is pay in advance. Ads are on a “good faith”

basis. Terms are “Until Forbid.”

Ads are Run of Press (ROP) unless accepted on a premium

contract basis. Limited premium space/rates available.

To keep rates to a minimum, all advertising must be prepaid

according to the schedule below. In exceptional cases where

special artwork or additional production is required, the

advertiser will be notified and billed accordingly. Rates are

not commissionable; proofs are not supplied. SPMC does not

endorse any company, dealer, or auction house. Advertising

Deadline: Subject to space availability, copy must be received

by the editor no later than the first day of the month

preceding the cover date of the issue (i.e. Feb. 1 for the

March/April issue). Camera‐ready art or electronic ads in pdf

format are required.

ADVERTISING RATES

Editor Sez

Benny Bolin

Required file submission format is composite PDF v1.3

(Acrobat 4.0 compatible). If possible, submitted files should

conform to ISO 15930‐1: 2001 PDF/X‐1a file format standard.

Non‐ standard, application, or native file formats are not

acceptable. Page size: must conform to specified publication

trim size. Page bleed: must extend minimum 1/8” beyond

trim for page head, foot, and front. Safety margin: type and

other non‐bleed content must clear trim by minimum 1/2”.

Advertising c o p y shall be restricted to paper currency, allied

numismatic material, publications, and related accessories.

The SPMC does not guarantee advertisements, but accepts

copy in good faith, reserving the right to reject objectionable

or inappropriate material or edit copy. The SPMC

assumes no financial responsibility for typographical

errors in ads but agrees to reprint that portion of an ad in

which a typographical error occurs.

Benny (aka goompa)

Space

Full color covers

1 Time

$1500

3 Times

$2600

6 Times

$4900

B&W covers 500 1400 2500

Full page color 500 1500 3000

Full page B&W 360 1000 1800

Half‐page B&W 180 500 900

Quarter‐page B&W 90 250 450

Eighth‐page B&W 45 125 225

8 months old. Crawling (albeit backwards—she seems to be

stuck in reverse!!). What fun and a joy she is—and that is

what I need right now. I am not playing on your emotions or

trying to get sympathy, just merely apologizing. I am

apologizing for the lateness of this and the last issue and for all

the errors I did not catch. Likewise for not answering your

emails in a timely manner. As a matter of explanation, since

the end of January I have been very distracted and in a fog at

times. My wife (Kim) of almost 43 years got a UTI and went

into total lung failure and suddenly passed away on February

11 (ironically, my mother’s birthday). The care was great but

the situation was horrible. It was made worse due to the fact

that I am a long-time (42 Years) ICU nurse and knew almost

way too much to handle it. Suddenly becoming a widower has

been a difficult life transition. The small things are hard—

cooking and shopping for one, being alone at night, etc. One

small glimmer of good was that we were able to donate her

kidneys. I encourage you all to love your family like you may

not have them in the future. They can be gone in an instant!

Enough about my sorrows. We are entering into the

summer and many shows are coming up. Summer FUN, ANA,

etc. Make plans to attend one now and think about exhibiting

or presenting an educational seminar. They are all fun. I am

going to be trying my hand at being a dealer. I was entrusted

with dispensing of a LARGE collection of fractional currency

collecion for a friend who passed away and decided to try to

get rid of some notes this way. So, if the you go to TNA

(Texas) show at the end of May/beginning of June, stop by and

see me.

I will also be attending the OKC ANA show for one day

since it is so close. Not as a table dealer but maybe a vest-

pocket one???

This issue of Paper Money has something we have not had

in a long time. It is a split article. This issue contains part 1 of

3. I don’t genterally do that as I don’t like to split articles but it

was necessary in this case due to how long it is. Let me know

what you think of this way of presenting it as I have received a

couple more long articles. So tell me—long or split?

Anyway—thanks for putting up with my old idiosyncrasies.

Have fun in the summer and wear sunscreen and a hat—Just

say NO to melanoma!

132

The Society of Paper Money

Collectors was organized in 1961 and

incorporated in 1964 as a non-profit

organization under the laws of the

District of Columbia. It is

affiliated with the ANA. The

Annual Meeting of the SPMC is

held in June at the International

Paper Money Show. Information

about the SPMC, including the

by-laws and activities can be

found at our website--

www.spmc.org. The SPMC does

not does not endorse any dealer,

company or auction house.

MEMBERSHIP—REGULAR and

LIFE. Applicants must be at least 18

years of age and of good moral

character. Members of the ANA or

other recognized numismatic

societies are eligible for membership.

Other applicants should be sponsored

by an SPMC member or provide

suitable references.

MEMBERSHIP—JUNIOR.

Applicants for Junior membership

must be from 12 to 17 years of age

and of good moral character. A parent

or guardian must sign their

application. Junior membership

numbers will be preceded by the letter

“j” which will be removed upon

notification to the secretary that the

member has reached 18 years of age.

Junior members are not eligible to

hold office or vote.

DUES—Annual dues are $39. Dues

for members in Canada and Mexico

are $45. Dues for members in all

other countries are $60. Life

membership—payable in installments

within one year is $800 for U.S.; $900

for Canada and Mexico and $1000

for all other countries. The Society

no longer issues annual membership

cards but paid up members may

request one from the membership

director with an SASE.

Memberships for all members who

joined the Society prior to January

2010 are on a calendar year basis

with renewals due each December.

Memberships for those who joined

since January 2010 are on an annual

basis beginning and ending the

month joined. All renewals are due

before the expiration date, which can

be found on the label of Paper

Money. Renewals may be done via

the Society website www.spmc.org

or by check/money order sent to the

secretary.

WELCOME TO OUR

NEW MEMBERS!

BY FRANK CLARK

SPMC MEMBERSHIP DIRECTOR

NEW MEMBERS 03/05/2025

Dues Remittal Process

Send dues directly to

Robert Moon

SPMC Treasurer

403 Gatewood Dr.

Greenwood, SC 29646

Refer to your mailing label for when

your dues are due.

You may also pay your dues online at

www.spmc.org.

15826 Craig Columbia, Website

15827 Michael Notarianni, Bank Note Rpr

15828 Stephen Haarstick,

15829 Bryan Scott, Don Kelly

15830 Delano Flemmer, Facebook

15831 Edward DeBellis, PMG

15832 Jason Douglas, Robert Calderman

15833 Michael Sandberg, Rahul Arora

15834 Chris Coulter, Robert Calderman

15835 Adam Mastronardi, Website

15836 Gregory Hester, Website

15837 Peter Jarzembovsky, Tatranska Webs

15838 Cameron Scheirer, Website

15839 Wayne Smith, Tom Denly

REINSTATEMENTS

None

LIFE MEMBERSHIPS

None

NEW MEMBERS 4/05/2025

REINSTATEMENTS

None

LIFE MEMBERSHIPS

None

15840 Steve Estes, Website

15841 Steve Blumberg, Robert V.

15842 Steve Blumberg, Robert V.

15843 Joel Bielinski, Website

15844 James Bowden, Website

15845 Jeffery Anderson,

15846 Ernest Molinari, Robert C.

15847 Ryan LaFountain, Website

15848 Robert Clarke, Website

15849 Ray Feller, Steven Feller

SPMC.org * Paper Money * May/June 2025 * Whole Number 357

133

Dennis J. Forgue of Westchester, Illinois, a Chicago

suburb, passed away peacefully April 12th after a lengthy

illness. He was 80 years of age. He was surrounded by

family, and was comfortable in his final days. He will be

sorely missed by all who knew him.

Mr. Forgue is survived by his brother Robert; his sis-

ter Holly (Jim) Cerny; his daughter Melissa Forgue-Heer-

both and her three children: Christopher, Daniel and

Aidan; and his son Martin (Debby) and their four chil-

dren: Samantha, Thomas, Ella and Nicolas. Dennis was

also a loving uncle to many nieces and nephews. He was

preceded in death by his brother Vernon and his beloved

wife Marcia Ann.

Mr. Forgue spent his childhood in central Illinois,

while his father was working for the State of Illinois in Springfield, before the family moved to the

Chicago area. He graduated from Proviso High School in Maywood and then attended Southern

Illinois University in Carbondale where he received a B.A. degree in U.S. History in 1966.

He began studies at Northwestern University School of Law and the John Marshall Law

School but, after a short time, decided to pursue a career in professional numismatics (the hob-

by and business of rare coins and currency). An offer was made to him to join the prestigious

firm of Rare Coin Company of America (Rarcoa) located in downtown Chicago, and he even-

tually became an officer of the company. After being employed there for more than a decade,

he launched his own business and then worked for Harlan J. Berk, Ltd. at the same Chicago

address that was previously occupied by Rarcoa. He held a position with that firm for a quarter

century and retired in 2019 after more than 50 years in the profession.

Although he was extremely knowledgeable about United States and Foreign Coins, his

specialty was rare United States Currency, a field in which he was recognized as a highly regard-

ed and distinguished expert. He was a 50-year member of the Professional Numismatists Guild,

receiving their Sol Kaplan Award in 1979 for his consumer protection work in the numismatic

marketplace. He was also a charter member and past President of the Professional Currency

Dealers Association, a more than 50-year member of the American Numismatic Association,

Central States Numismatic Society, American Numismatic Society, Tokens and Medals Society,

the Manuscript Society, and many others. He was member #1067 of the Society of Paper

Money Collectors. He could almost always be seen at his table at man of our shows.

Mr. Forgue was a long-time member and supporter of the Chicago Zoological Society

and Brookfield Zoo and was particularly fond of their animal care and conservation projects. In

the summer of 2018 he accompanied a group, sponsored by the zoo, on a wildlife tour of Kenya

and said about that trip that he had “the time of his life!”

DENNIS J. FORGUE

July 10, 1944 ~ April 12, 2025

SPMC.org * Paper Money * May/June 2025 * Whole Number 357

134

BLANTON DUNCAN’S ONES AND TWOS

The Story of the Confederate Treasury’s First Change Notes

Part One of a Three-part article by Mark A. Coughlan

1. Introduction

The Act of April 17th, 1862, approved by the Confederate States Congress, authorized the issue of a further $170

million in Treasury bonds and notes. The vast majority of the Issue would be composed of interest-bearing $100

notes, known by the Treasury as ‘Seven-Thirty’ notes because they paid interest at 7.3% per annum, or two-cents per

day. In addition, for the first time in any Issue, the Confederate Treasury earmarked a small sum of $5 million, for

low denomination $2 and $1 change notes. This amount was later increased to $10 million by the Act of September

23rd, 1862. The Treasury had previously resisted issuing any government notes in denominations below $5 because

it felt that such low value notes would dishonour the national currency. However, the reality was that due to the

removal of specie (coins) from circulation, there was great public demand for change notes, and in the absence of

any government issue, a plethora of unregulated, home-grown alternatives were soon introduced by municipalities,

small businesses, and shop-keepers, creating a financial risk.

The contract for producing these new $2 and $1 notes was given to Blanton Duncan, the cantankerous

businessman from Louisville, Kentucky. Duncan had been in the engraving and printing business for less than twelve

months, but even so, this should have been a straightforward assignment. Unfortunately, the manufacture of these

change notes proved to be a particularly frustrating episode for both Duncan and the Confederate Treasury; it also

left the citizens of the Confederate States somewhat bewildered by three different versions of the new $2 note, and

two different versions of the $1 note. Anyone could be forgiven for thinking that Duncan and his engravers had been

enjoying too much of South Carolina’s famous corn whiskey following their relocation to Columbia!

1.1 Duncan’s Early Life and Career Henry Blanton Duncan (1827-1902), from Louisville in

Kentucky, was the only child of William Garnett Duncan, a wealthy lawyer, businessman, and politician who served

in the United States House of Representatives between 1847 and 1849. Son followed father into the legal profession,

but the energetic and ambitious young Duncan quickly became bored with the slow pace of life as a lawyer and turned

his attention to politics. Duncan served as a political administrator and activist, initially for the Whig party, but later

for more radical and divisive movements such as the “Know Nothing Party”; as the moral and political divisions

between North and South intensified, Duncan established himself as a strong supporter and vocal advocate of

Southern independence.

The formal secession of South Carolina in December 1860 - followed by six more Southern States in early 1861

- soon escalated into hostilities, beginning with the bombardment of Fort Sumter in April 1861, and thereafter, a full

state of War between North and South. Even though Kentucky had not seceded at that time - the divided border state

SPMC.org * Paper Money * May/June 2025 * Whole Number 357

135

had adopted a fragile neutral status - Duncan’s Southern patriotism led him to form

and equip the 1st Kentucky battalion of Confederate volunteers at his own expense.

In May 1861, appointing himself as the unit’s Colonel, Duncan marched his battalion

to Richmond, Virginia, placing the unit at the service of the Confederate War

Department.

Duncan’s energy, enthusiasm, and considerable ego, soon resulted in clashes

with his military superiors, and when denied promotion to the rank of Brigadier

General, he resigned in early July 1861. However, not to be outdone, Duncan served

as an unofficial adjutant on the staff of General Pierre Gustave Toutant Beauregard

at the Battle of Manassas (Bull Run) on July 21st, 1861. Duncan had a tenuous link

to Beauregard through his father, Garnett, who had moved to New Orleans in 1850,

and had become a trusted legal advisor to the General’s family.

Basking in the glory of the South’s victory in this first major battle of the

War, Duncan returned to Kentucky, where he once again turned his attention to

politics. Kentucky’s fragile neutrality in the War had been violated on September

4th, 1861, by the Confederate military occupation of the town of Columbus, a

strategic centre for railroad and river communications. Federal forces wasted no time in occupying the strategic

railroad town of Paducah, and the pro-Union Governor happily declared Kentucky’s allegiance to the United States.

However, Duncan and other Southern sympathisers organised a Secession Convention, held in Russellville in

November 1861, and this led to the establishment of a shadow Confederate state government, and in Kentucky being

recognised as the thirteenth Confederate State.

These patriotic activities undoubtedly brought Duncan to the attention of the Confederate authorities in

Richmond. Duncan had also used his connections in Kentucky and the neighbouring Northern border states to acquire

supplies of paper and ink which were desperately-needed by the Confederate Treasury for the manufacture of its

paper money. Seeing a business opportunity, and capitalising on the goodwill that his patriotic efforts had engendered

with the Secretary Christopher G. Memminger at the Treasury, Duncan set about establishing a new engraving and

printing business during the latter part of 1861.

Duncan was neither engraver nor printer, but quickly built up his new business in Richmond, Virginia, by hiring

respected and experienced professionals such as R.F. Wagner from Nashville, Tennessee, and by brazenly poaching

as many staff as he could from local competitors such as Hoyer & Ludwig. Duncan, who habitually used his military

title of Colonel, also pretended that his new engraving and printing business was operating under the control of the

Confederate Department of War, and this illusion gave him preferential access to equipment, supplies, and the dozens

of newly-arrived engravers and printers from Great Britain who the Treasury had arranged to be smuggled into the

Confederacy aboard blockade running ships. Duncan’s business partner and deputy was Dr. George R. Ghiselin, a

geologist and engineer who had previously been involved in coal mining concerns in Hancock County, Kentucky.

Ghiselin, like Duncan, was also a political activist opposed to the Northern Republicans, and doubtless this had

brought the two men together.

Duncan’s new business, located on the corner of 13th Street and Cary in Richmond’s commercial district, began

life by printing books for the War Department, most notably “Uniform and Dress of the Army of the Confederate

States”, a colourful depiction of the military attire worn by Confederate Infantry, Cavalry, and Artillery units.

However, Duncan’s primary objective was to secure larger government contracts, which he assumed would be highly

profitable and would also enhance his social status. Duncan’s persistent lobbying of Treasury Secretary Memminger

soon won him a contract with the Confederate Treasury, who at that time were engaged in the large Third Issue of

Treasury notes.

1.2 Duncan’s early Third Issue Treasury Notes

Under the Act of August 19th, 1861, $100 million of new Treasury bonds and notes was approved for the Third

Issue; the Act of December 24th, 1861, authorized an additional $50 million, although almost $300 million was

eventually issued in order to fund spiralling government spending as the War intensified. With only a handful of

engraving and printing companies located in the South at the beginning of the War, Richmond-based Hoyer & Ludwig

had dominated the Second Issue, manufacturing all but 15,556 of the 685,612 Treasury notes involved, as well as

Figure 1. Blanton Duncan circa 1860

(Image courtesy of Mary L.

Duncan).

SPMC.org * Paper Money * May/June 2025 * Whole Number 357

136

various Treasury bonds. However, the quantities involved in the Third Issue were significantly greater, demanding

more engraving and printing capacity, and thus, with the active support and encouragement of the Confederate

Treasury, new engraving and printing companies such as those of Blanton Duncan, and of Leggett, Keatinge & Ball

established themselves in Richmond, Virginia, during the latter part of 1861. Duncan’s company - like the early

frontrunner, Hoyer & Ludwig - only possessed the capabilities to produce notes in the lithographic method, a

planographic process which involved printing from a flat surface, one which had been engraved in a particular way.

Lithography is based on a simple principle, whereby the printing medium is the flat surface of a polished slab of

a specific type of limestone, which contains both the image- which has been drawn on using ink-absorbing substances

- and the non-image areas - which are coated with ink-repelling substances. These porous, yellowish stones were

made from a particular type of limestone which were mined at a quarry at Solnhofen, in Bavaria. Lithography was a

popular method of engraving and printing in the mid-nineteenth century, and it was possible to produce high quality

printed images, as can be seen from various individual pieces of art work, maps, and newspaper publications of the

time. However, this required considerable skill and patience and was not suited to the mass production of bank notes

which by their nature were small in size and would be exposed to considerable wear and tear.

The industry leading engraving and printing companies of the age, who were all based in the Northern states,

possessed the skills and technology to manufacture elegant and intricate designs upon steel plates using the intaglio

method, whereby the image was incised into the surface. These companies, such as the American Bank Note

Company, and the National Bank Note Company, had been engaged by the Confederate Treasury to produce its very

first notes and bonds, but the outbreak of War understandably prevented any further such trade between the

Confederacy and these Northern manufacturers, and Secretary Memminger was forced to make the best of the handful

of small lithographic engraving companies that were located in the South. The resulting notes, lithographed by Hoyer

& Ludwig, Jules Manouvrier, and later Duncan Blanton’s company, were generally crude - Treasury Secretary

Memminger admitted to being embarrassed by the poor quality and even described them as “ugly”. More worryingly,

these amateurish notes were very susceptible to counterfeiting.

The first Confederate Treasury notes produced by Duncan’s company were the $10 (T29) and the $5 (T37); this

work would have been started in late 1861, with the notes being issued by the Treasury from March 17th and April 7th

respectively of that year.

Figure 2. Typical 1861 Third Issue note produced by Duncan - $5 (T37).

Duncan had barely got his business up and running - producing 286,627 of the $10 (T29) notes, and some

664,620 of the $5 (T37) notes for the Treasury - when he was forced to stop his presses in late April 1862. In the

spring of 1861, the Confederate authorities became alarmed by the launch of U.S. General McClelland’s Peninsula

campaign, with over 100,000 enemy soldiers advancing on Richmond. The Treasury decided to relocate its key

suppliers to a safer location, almost four hundred miles to the south in Columbia, South Carolina.

1.3 Duncan’s later Third Issue Treasury Notes

Surprisingly, some companies refused to comply with the Treasury’s request, but Blanton Duncan, hoping to

gain business advantage, readily agreed, and hastily arranged for the relocation of his employees, his machinery, and

his supplies by rail and wagon to the Palmetto State. By mid-May of 1862 Duncan’s company had resumed its

operations in Columbia, housed in the Charles Beck building, which was located on the southeast corner of Main and

SPMC.org * Paper Money * May/June 2025 * Whole Number 357

137

Washington Streets. A second series of the $5 (T37) note (some 338,672 notes) was soon delivered, along with a

combined total of almost five million new $20 (T20) and $10 (T30) notes. Whilst this level of output was welcomed

by the Treasury, Duncan’s work continued to be of average quality and an easy target for counterfeiters; his

lithographed designs were markedly inferior to the steel engraved designs being introduced by the Treasury’s

preferred supplier, Keatinge & Ball, who had also relocated to Columbia, South Carolina from Richmond.

Hoyer & Ludwig, who had come to the Treasury’s rescue in mid-1861 by rapidly producing millions of Second

and Third Issue notes, had declined to relocate to Columbia. Secretary Memminger could not force the company to

move – it was after all a private company, not Government-owned - but he could terminate its contracts with the

Treasury. He could also request the return of the equipment and personnel which had been leased to Hoyer & Ludwig

to facilitate its rapid expansion. The result of this was that Hoyer & Ludwig was forced to sell a large part of its

business, and the new owner was James T. Paterson, a Scottish-born dental surgeon who previously ran a successful

medical practice in Augusta, Georgia. Paterson was well connected politically and socially in Georgia, with Vice

President Alexander H. Stephens personally lobbying Treasury Secretary Memminger on the Scotsman’s behalf.

Paterson saw an opportunity to enrich himself by printing bank notes for the Confederate Treasury, whilst also

ensuring that he would be exempted from military conscription. Paterson and Memminger agreed terms, and the bulk

of Hoyer & Ludwig’s business was soon transferred to Columbia, where operations resumed under Paterson’s name.

The competition for Treasury contracts in Columbia was intense, with three suppliers already on the ground in

mid-1862, and a fourth - Evans & Cogswell - set to arrive before the year was out. Whilst the quality of Duncan’s

work relative to his peers certainly disadvantaged him - despite his efforts to undercut his competitor’s prices - a

second problem was his cantankerous nature and his questionable business practices.

Winning was everything to Duncan, and he had no qualms about playing dirty, constantly looking for ways to

nobble his competitors. This led to a toxic environment amongst the engraving and printing companies in Columbia,

with frequent disputes and even violent incidents which Treasury officials could not ignore. Joseph D. Pope, the mild-

mannered and highly respected professor of law who ran the Treasury Note Bureau in Columbia at that time, was

driven to despair by this un-Southern behaviour.

Pope particularly abhorred Blanton Duncan, referring to him as a “vulgar Western braggart” and on several

occasions raised concerns to Secretary Memminger regarding the Kentuckian’s mental health. These ongoing

problems resulted in Duncan being placed at the back of the queue for any new contracts, and this was evident with

the Fourth Issue of Treasury notes.

1.4 Duncan and the Fourth Issue of Treasury Notes

As mentioned previously, the primary aspect of the Fourth Issue was the introduction of the $100-denominated

7.30% interest-bearing notes, and over $120 million worth were issued by the Treasury between May 5th, 1862, and

January 16th, 1863. These notes could be acquired at par in exchange for earlier non-interest-bearing notes and were

intended to offer the investment benefits of a bond, but also the flexibility of paper money should the holder wish to

use the note for some purpose or other. The notes proved extremely popular, but were circulated freely rather than

being held, and thus, did not have the desired effect of reducing the amount of money in circulation as the Treasury

had hoped. Contracts to manufacture the $100 notes were issued to two suppliers in early April 1862, namely Keatinge

& Ball, and Hoyer & Ludwig, resulting in two different designs, although the latter company’s contract was soon

novated to James T. Paterson & Co. for the reason previously explained. These notes are extremely popular with

collectors, and the subject of many articles in the SPMC archives, so will not be covered further here.

The new $2 and $1 change notes, were of much lower priority to the Treasury, but nonetheless were important,

although the Treasury did not wish to distract Keatinge & Ball or Hoyer & Ludwig with this work. A letter sent by

Secretary Memminger, dated May 21st, 1862, instructed Blanton Duncan to take on this work from his new premises

in Columbia, South Carolina:

“As soon as you can make up the arrears, resulting from the removal of your establishment, I wish you to make

a plate of ones and twos and print them.”

Memminger followed-up with another letter just two days later, demanding that Duncan should focus all of his

operational capacity on the manufacture of these change notes for the Confederate Treasury, and not to be distracted

by any other requests (Duncan had been in discussions with the North Carolina State Treasury to produce a set of

notes):

SPMC.org * Paper Money * May/June 2025 * Whole Number 357

138

“We have also been obliged to notify disbursing officers to confine their checks to multiples of fives, for want of

ones and twos. Under these circumstances we need the utmost power of all your force. I hope therefore you will at

once answer all applications to you for printing by a simple refusal, without referring them to me.”

Duncan set to work, and by the end of May presented some essay notes to the Treasury for review. Whilst

Memminger was keen to get things moving, he was also cost-conscious, and in a letter of June 4th, 1862, informed

his subordinate, Joseph D. Pope at the Treasury Note Bureau in Columbia that these change notes should be of a

smaller size than the standard measurements which were used for other denominations, namely 3 to 3¼ inches by 7

to 7¼ inches in size. Memminger provided an example of an 1861 $1.50 note - sized at 2¾ by 6⅛ inches - which had

been manufactured by John Douglas for the New Orleans, Jackson & Great Northern Rail Road Company, stating

the benefits:

“It is a very pretty plate, has but one number, and is so small that it will not lumber the pocket. It is probable too

that ten notes can be put upon a sheet instead of eight - all of which are improvements. I think, therefore, Duncan had

better get up other plates of this size, instead of the plates he has made.”

Figure 3. 1861 New Orleans, Jackson & Great Northern Rail Road Co. Change Note.

Thus, Duncan’s engravers were forced to return to the drawing board - or rather the engraving stone - to comply

with Memminger’s request. It took some two weeks for the necessary changes to be made, as a letter to the Treasury

dated June 13th, 1862, from Dr. G.R. Ghiselin, Duncan’s deputy, confirmed: “Will commence printing $2 bills

tomorrow”. However, another letter from Ghiselin dated June 14th, 1862, indicated that this did not happen. Duncan

had requested a last-minute alteration, namely, to erase one of the two serial number boxes which featured in the

note’s design - Secretary Memminger had been specific that only one serial number was required to be written onto

these low value notes.

2. THE FOURTH ISSUE $2 NOTE

2.1 Design features of the $2 note

The central vignette prepared by Duncan’s engravers for this note is generally referred to as “The South striking

down the Union” (see Figure 4 below), and a letter at the time from Duncan himself to Secretary Memminger

confirmed this was the intention.

Figure 4. Central

vignette adopted by B.

Duncan for the 1862

Fourth Issue $2 note.

SPMC.org * Paper Money * May/June 2025 * Whole Number 357

139

However, this scene was unquestionably drawn from Greek mythology, being based on the fable of Hercules

liberating the titan Prometheus from his imprisonment and interminable torture. Prometheus, was the god of fire and

credited with the creation of the human race, to which he imparted certain valuable skills and technologies.

Prometheus was punished for this action by Zeus - King of the Gods - and placed in chains for eternity at the

top of a mountain, where each day an eagle would attack him, eating his liver. Being immortal, Prometheus could

recover from his wounds each night, but his suffering was endless until he was liberated by the demigod, Hercules,

who, in exchange for his kind deed, wished to glean valuable knowledge from the Titan which would help in his own

quest for immortality. The Author has developed the following interpretation of this dramatic scene:

Southern pride and military power - as represented by the angry, sword-bearing female warrior on the left - can

be seen slaying a ferocious eagle. This bird of prey is intended to symbolize the North, and its aggressive, invasive

nature. The distressed maiden to the right, pinned to the ground, was probably intended to symbolize the South, which

was thus saved from the unwelcomed Northern oppression by the action of the brave sword-bearing female warrior.

In short, the Southern Army would unquestionably triumph over the Northern invader and protect the innocent

citizens of the South. This was not actually how things worked out, and much destruction was wrought upon the

citizens of the Confederate States as Federal military leaders introduced the world to total warfare, focusing on

civilian targets as well as military ones.

In the top left-hand corner was a second vignette, bearing the bust of Judah P. Benjamin (1811-1884). Although

born in London, Benjamin’s family, who were merchants from the Sephardic Jewish community, moved to the British

colony of St. Croix in the Caribbean, when he was an infant. From there, the family moved to the United States,

eventually settling in New Orleans, Louisiana, where Benjamin established himself as a successful lawyer and

statesman.

When the Confederate States government was formed in late February 1861, President

Jefferson Davis appointed Benjamin to the position of Attorney General. In November 1861

he was reassigned to the position of Secretary of War, but his lack of military experience

led to repeated clashes with key Generals, and resulted in President Davis quickly changing

Benjamin’s role again, this time to Secretary of State; he served in this role until the end of

the War.

Following the collapse of the Confederate government in 1865, Benjamin and his

family fled to London, where he worked successfully for many years as a barrister. His

final years were spent in Paris, where he died from heart disease, almost thirty years after

he had fled the Confederacy. Benjamin’s bust became a standard feature on all $2

Confederate notes after the Fourth Issue, appearing on the T54 note from the Fifth Issue

(dated December 2nd, 1862), the T61 note from the Sixth Issue (dated April 6th, 1863), and

the T70 note from the Seventh Issue (dated February 17th, 1864). Whilst this was

impressive, it would appear that in Confederate money parlance, a “Benjamin” was

considerably less valuable than its namesake today!

With the design features and the physical size now finalised, the actual production work should have proceeded

smoothly for Blanton Duncan, but, unfortunately, this would not prove to be the case.

2.2 The $2 error note (T38) and its replacement the (T42) note

Treasury correspondence indicated that, after almost a month of preparatory work to design and engrave the new

change notes, Duncan’s presses began printing the First Series of $2 notes on Monday June 16th, 1862, producing 947

sheets representing 9,470 notes with a face value of $18,940. Blanton Duncan himself was not present in Columbia

at that time, so the task of monitoring production and submitting the required production reports to Treasury officials

fell to his deputy, Dr. Ghiselin. The Treasury Note Bureau closely monitored the production of all of its suppliers to

ensure that they were delivering the promised quantities of Treasury notes and bonds on a daily basis. Figure 6 (below)

shows the report from Duncan’s company from June 17th, 1862. These reports were also used to reconcile suppliers’

invoices. The table below this- Figure 7 is extracted from the relevant daily activity reports for the week of Monday

June 16th, 1862, to Saturday June 21st, 1862, and summarises the quantities of $2 notes produced by Duncan’s

company during that period, some 178,670. These notes would have been speedily delivered to the Treasury Note

Bureau, where they would be registered, numbered, signed, and cut into individual notes before being issued.

Figure 5. Upper lefthand

corner vignette adopted

by B. Duncan for the 1862

Fourth Issue $2 note.

SPMC.org * Paper Money * May/June 2025 * Whole Number 357

140

Treasury correspondence indicated that, after almost a month of preparatory work to design and engrave the new

change notes, Duncan’s presses began printing the First Series of $2 notes on Monday June 16th, 1862, producing 947

sheets representing 9,470 notes with a face value of $18,940. Blanton Duncan himself was not present in Columbia

at that time, so the task of monitoring production and submitting the required production reports to Treasury officials

fell to his deputy, Dr. Ghiselin. The Treasury Note Bureau closely monitored the production of all of its suppliers to

ensure that they were delivering the promised quantities of Treasury notes and bonds on a daily basis. Figure 6 (below)

shows the report from Duncan’s company from June 17th, 1862. These reports were also used to reconcile suppliers’

invoices. The table below this- Figure 7 is extracted from the relevant daily activity reports for the week of Monday

June 16th, 1862, to Saturday June 21st, 1862, and summarises the quantities of $2 notes produced by Duncan’s

company during that period, some 178,670. These notes would have been speedily delivered to the Treasury Note

Bure, where they would be registered, numbered, signed, and cut into individual notes before being issued.

Date QuanƟty of sheets QuanƟty of notes Value of notes

June 16th, 1862 947 9,470 $18,940

June 17th, 1862 1,992 19,920 $39,840

June 18th, 1862 2,848 28,480 $56,960

June 19th, 1862 3,939 39,390 $78,780

June 20th, 1862 3,953 39,530 $79,060

June 21st,, 1862 4,188 41,880 $83,760

Weekly total 17,867 178,670 $357,340

Figure 7. Summary of $2 notes manufactured during first week of production.

Figure 6. Extract of Duncan’s Production Report for June 17th, 1862.

SPMC.org * Paper Money * May/June 2025 * Whole Number 357

141

Unfortunately, upon delivery of the first shipment of these $2 notes to the Treasury Note Bureau, a significant error

was discovered - the note had been engraved with the wrong Issue date. These $2 non-interest-bearing notes which

formed part of the Fourth Issue were supposed to have been dated June 2nd, 1862, but Duncan’s engravers had

mistakenly used the Third Issue date of September 2nd, 1861, [see Figure 8 below]. Whilst this may seem like an

elementary mistake, it should be noted that, at that time, Duncan was still operating under instructions from the

Treasury to print large quantities of his Third Issue $5 (T37), $10 (T30), and $20 (T20) notes, which were dated

September 2nd, 1861.

In his daily report to Secretary Memminger dated June 17th, 1862, Duncan responded to the Treasury’s discovery

of the problem, but played it down, and attempted to deflect any blame away from his company:

“The draft of the $2 which I sent to you, and which was approved, bore date September 2, 1861, and was

accordingly so engraved. I presume that all the supplemental acts would refer back to the original and bear same

date.”

Figure 8. 1862 Fourth Issue $2 First Series Error Note (T38) - Image courtesy of Heritage Auctions.

Nonetheless, Duncan acknowledged the error, and informed Secretary Memminger that he had already instructed

his engravers to change the date to June 2nd, 1862. Duncan added that, in addition to the initial quantity of notes

delivered to the Treasury Note Bureau, he had a further 29,000 notes (290 sheets) of these incorrectly-dated notes on

hand at his factory, which he hoped could/would still be accepted by the Treasury.

A later communication - issued that same day - from Duncan to Secretary Memminger increased the estimate of

error notes on hand at the factory to 35,000; the presses had obviously still been running whilst these discussions had

been going on. [Note - A small quantity of these notes had already been sent to the Treasury]. Whilst the Author has

not been able to find any correspondence from the Treasury records which confirmed any specific course of action,

it appears that the stock of these incorrectly-dated $2 sheets was used by the Treasury and placed into circulation.

Hundreds of surviving notes have been discovered which bear the tell-tale signs of wear and tear, which was

considerable in most cases.

This might have been because the problem was not discovered before some of the new $2 notes had already

been placed into circulation, but since Treasury correspondence indicated that the incorrect date had been discovered

very quickly, the Author is inclined to believe that, after some deliberation, the Treasury simply decided to use these

error notes. The Treasury department was under huge pressure to issue more notes of all denominations, paper and

other materials were in short supply, and the ultimate responsibility for the $2 date error rested with themselves. The

error notes were still legal tender and at least had a valid date for the Third Issue, even if they were funded as part of

the Fourth Issue - the Third Issue, was already significantly over budget by at least $80 million, so this small additional

sum of wayward $2 notes was trivial. Thus, it made sense to use the notes rather than destroy them.

Early collectors assumed that the $2 September 2nd, 1861, note was an undocumented part of the Third Issue,

but research by later numismatists (dating back to H.D. Allen in his September 1917 article in the Numismatist)

revealed the truth, that it was an incorrectly-dated Fourth Issue note. Based on observations of a selection of surviving

SPMC.org * Paper Money * May/June 2025 * Whole Number 357

142

notes, and Duncan’s own correspondence from that time, it was believed that some 35,000 of these $2 error notes, all

First Series, had probably been issued. Classifications for the $2 error note and for its replacement are shown in the

table below:

Note and Reference

J.W. Haseltine

Guide (1876)

W.W. Bradbeer

Book (1915)

Philip H. Chase

Book (1947)

Grover Criswell

Jr. Book (1957)

$2 error note

Dated September 2nd,

1861

54 286 113 38 / 286

$2 corrected

note Dated June 2nd,

1862

63 334-337 205 42 / 334-337

Figure 9. Classification of $2 error note and its replacement.

The classification system defined by Grover Criswell Jr. in the late 1950s has become the de facto standard for

Confederate Treasury notes, and thus the universal term used today for the $2 error note is the T38, and for the

corrected note is the T42, and this classification will be used throughout this article.

Figure 10. 1862 Fourth Issue $2 First Series Corrected Note (T42) - Image courtesy of Heritage Auctions.

The Fourth Issue, $2 (First Series), ran from serial numbers 1 - 47000, with plate letters 1 to 10, thus, giving a total

of 470,000 notes. Based on observations by experts over the years, the $2 (T38) error notes are all known to have

been part of the First Series, with lowish serial numbers, as detailed in the table below:

First Series - Serial Number Range Quantity of Notes Issued

1 - 2000 (plate numbers 1 to 10) 20,000

4101 - 4800 (plate numbers 1 to 10) 7,000

5001 - 5800 (plate numbers 1 to 10) 8,000

TOTAL 35,000

Figure 11. Previously estimated serial number ranges of $2 Error Note (T38).

Although it is known that Duncan quickly began delivering the sheets containing the new $2 notes to the

Treasury Note Bureau - and this was how the error was quickly discovered - it is also known, from Treasury records,

that none of these $2 notes were processed by clerks in the Treasury Note Bureau for numbering, signing, and cutting

until July 1st, 1862. Priority at that time was being given to higher value $5, $10, and $20 notes from the tail-end of

the Third Issue, and after this, the new interest-bearing $100 notes from the Fourth Issue.

Once Treasury officials had made the decision to retain the error notes rather than to destroy them, they were

duly signed, numbered, and cut to size by the Treasury Note Bureau clerks, alongside stocks of the corrected notes

which Duncan had begun delivering. Thian, in his Register of the Confederate Debt, made no distinction between

these two types of First Series $2 notes - viewing them all as one contiguous block of serial numbers / signers (pages

SPMC.org * Paper Money * May/June 2025 * Whole Number 357

143

39-40) in the section covering the Act of April 17th, 1862. He similarly summarised this First Series of $2 notes under

the Act of April 17th, 1862, on page 175:

“1-1 to 10-10, 1st Series 1-47000 $940,000.00”

Over the last three years, the Author has been engaged in a project to address the gaps and anomalies in Thian’s

Register, with the objective of creating a digital (relational database) version of the original paper-based manuscript,

enriched with newly discovered data, and with known errors corrected. This work has required, amongst many other

things, some detailed research into the surviving population of Fourth Issue $2 and $1 notes, looking at a wide range

of data sources such as dealer websites, auction house archives, books, online collections, and private collections.

As a result of this research to date, the Author believes that the total quantity of type T38 notes issued was

probably 37,000, slightly higher than the previous consensus of 35,000; although, this figure could increase further

to 39,000 if some of the currently unobserved blocks of serial numbers (e.g. 2001-2200) proved to be formed of type

T38 notes. It should be stated that is also possible that the sheets of T38 and T42 notes were so liberally interspersed

that it is possible that a single serial number block of one hundred notes could be composed of a mixture of both

types. No examples of this have been witnessed to date, but the only way that this could be determined with absolute

certainty would be to observe each and every First Series serial number. This is a task that is likely to be impossible.

The summary table below (Figure 12) summarises the results of this research so far for the First Series of $2 notes:

Figure 12. Revised serial number ranges of First Series $2 notes containing types T38 and T42.

As we know from Treasury records, Duncan’s company printed 29,930 $2 notes in the first two days of

production before the problem was identified, and these would have been engraved with the incorrect date of

September 2nd, 1861. A further 28,480 $2 notes were produced on the third day, and it is probable that at least some

of these would have been the type T38 error notes, printed before production was halted and Duncan’s engravers

were required to make a hasty correction to the plates (stones) used for printing. Ongoing research may unearth new

evidence, but for now the Author is confident to state the quantity of First Series T38 notes issued as being 37,000,

with the balance of 433,000 notes being type T42.

[TO BE CONTINUED]

SPMC.org * Paper Money * May/June 2025 * Whole Number 357

144

Lyn Knight Currency Auct ions

If you are buying notes...

You’ll find a spectacular selection of rare and unusual currency offered for

sale in each and every auction presented by Lyn Knight Currency

Auctions. Our auctions are conducted throughout the year on a quarterly

basis and each auction is supported by a beautiful “grand format” catalog,

featuring lavish descriptions and high quality photography of the lots.

Annual Catalog Subscription (4 catalogs) $50

Call today to order your subscription!

800-243-5211

If you are selling notes...

Lyn Knight Currency Auctions has handled virtually every great United

States currency rarity. We can sell all of your notes! Colonial Currency...

Obsolete Currency... Fractional Currency... Encased Postage... Confederate

Currency... United States Large and Small Size Currency... National Bank

Notes... Error Notes... Military Payment Certificates (MPC)... as well as

Canadian Bank Notes and scarce Foreign Bank Notes. We offer:

Great Commission Rates

Cash Advances

Expert Cataloging

Beautiful Catalogs

Call or send your notes today!

If your collection warrants, we will be happy to travel to your

location and review your notes.

800-243-5211

Mail notes to:

Lyn Knight Currency Auctions

P.O. Box 7364, Overland Park, KS 66207-0364

We strongly recommend that you send your material via USPS Registered Mail insured for its

full value. Prior to mailing material, please make a complete listing, including photocopies of

the note(s), for your records. We will acknowledge receipt of your material upon its arrival.

If you have a question about currency, call Lyn Knight.

He looks forward to assisting you.

800-243-5211 - 913-338-3779 - Fax 913-338-4754

Email: lyn@lynknight.com - support@lynknight.c om

Whether you’re buying or selling, visit our website: www.lynknight.com

Fr. 379a $1,000 1890 T.N.

Grand Watermelon

Sold for

$1,092,500

Fr. 183c $500 1863 L.T.

Sold for

$621,000

Fr. 328 $50 1880 S.C.

Sold for

$287,500

Lyn Knight

Currency Auctions

Deal with the

Leading Auction

Company in United

States Currency

$10 18-Subject Intermediate Size

Plate Serial Number 1597 Backs

and other Wrong Size Plate Serial Numbers

The focus of this article is intermediate size back plate serial number 1597 on $10 1950A,

B and C FRNs, a variety that few people know about because nothing much has been written about

it. Along the way, we’ll look at its cousins.

Decades ago, someone pointed out 1597 on the back of a $10 Federal Reserve note from

the 1950 series. Here is what I learned about it.

The notes bearing the variety were printed from an 18-subject flat plate. Those were the

last plates used to print notes on wetted paper. Consequently, the notes bearing the variety have

terrific eye appeal characterized by crisp inks and paper that possesses a distinctive crackling

The Paper

Column

Peter Huntoon

Figure 1. $10 1950A FRN with intermediate size back plate serial number 1597, Back

1597 also was mated with 1950B and C FRN faces.

Figure 2. Size comparison between micro (228), intermediate (1597) and macro (1335) plate serial numbers,

SPMC.org * Paper Money * May/June 2025 * Whole Number 357

146

texture and feel when new.

Many collectors of small size notes refer to notes printed on wetted paper as coming from

the classic small note era; specifically, notes printed from 12- and 18-subject flat plates used for

the 1928 through 1953 series.

I watched for the proof for 1597 among the 18-subject proofs as we were sorting the proofs

at the Smithsonian. When it appeared, I saw that the plate was certified for use on August 20, 1954

and all 18 subjects had intermediate size plate serial numbers. The plate was made a little too late

to have appeared on Series of 1950 Clark-Snyder notes.

The plate number in the plate margin was 5125, which is from a running set of numbers

assigned to small size backs of the various denominations of that vintage. In contrast, plate serial

numbers differ from plate numbers in that they thread only through the plates of the same

denomination and are the little numbers found within the notes.

Jamie Yakes located records for the use of the plate in the National Archives in January

2024. They reveal that it saw extensive service in numerous press runs inclusive of August 22,

1954 and July 5, 1962. Its long life is attributed to numerous re-entries.

Of course, the plate was used to produce notes for any number of Federal Reserve districts

in each of the 1950A, B and C series, including star notes. I don’t know of anyone who has

attempted to catalog the possible varieties.

I found only one star note with a l597 back, a Series of 1950A with serial B17398034*. I

let it go to Logan Talks who for years maintained a census of scarce and rare small size notes. He

always appreciated plate number varieties on replacement notes. As I was writing this article, I

remembered that note so I contacted him to see if he recorded the serial number. I’ll be darned if

he didn’t still have the note for you to see.

The real challenge for me was to find the variety on a $10 1953 series silver certificate

because 1597 had to have been used on some silvers. I have looked at a slew of 1953 $10 silvers

over the years and never found one. They have to be rare based on my frustrated experience,

Small size U.S. variety collecting has enjoyed a huge surge in popularity during the past

several years. One area that has received attention are the notes with wrong size plate serial

numbers. They certainly add to enjoyment for those who have the patience to pursue them. Some

Figure 3. Logan Talks’ $10 Series of 1950A star note with intermediate back

1597 is proof that as expected the variety comes in the form of replacement

notes.

SPMC.org * Paper Money * May/June 2025 * Whole Number 357

147

turn out to be rarities.

Three very popular

and avidly collected varies

that have come down the

pike are these: (1) $5 Series

of 1934B New York

Federal Reserve notes from

face plate 212 with

intermediate size plate

serial numbers on all

subjects, (2) intermediate

backs that occurred on the

right half of 32-subject back

plate 1821 used to print $1

1974 FRNs, (3) $1 1988A

FRN face 106 made for use

in Fort Worth that carried a

large plate number

otherwise reserved

exclusively for the backs

printed at Fort Worth.

One stellar

unreported possibility is a

$5 1934B FRN New York with intermediate face 212 mated with micro back 637. This potential

find ranks at the absolute top of my list as the ultimate small note variety. Plate 637 was in use

when 212 faces were being printed. Someone is going to score big time by finding one.

Robert Calderman reeled in a spectacular $5 FRN changeover pair in 2023 consisting of a

1934A and 1934B 212; respectively bearing serials B78811218B and B78811219B. This

significant discovery was the first such pair ever reported. The stuff is out there, all you have to do

is look.

Intermediate size plate serial numbers were first brought to my attention by a die-hard small

size variety collector named Meyer Fulda in 1970. Meyer, a contemporary of small note cataloguer

Figure 4. $5 FRN New York 1934B with intermediate size face plate serial

number 212, probably the first intermediate small size plate serial number

recognized by numismatists. Find this variety on a star note and you will have

come up with a stellar rarity. Find it mated with micro back 637 and you will

have discovered the ultimate variety sought by small note variety collectors.

Figure 5. Comparison between normal back plate serial number 1821 on the left and intermediate on

the right. These appeared on 1974 FRN $1s. The intermediate numbers occurred only on the right

half of the back plate. The challenge is to find specimens of both sizes. The normal 1821 is the hardest

to find. The note that provided the normal 1821 shown here happened to have serial K73337333A.

SPMC.org * Paper Money * May/June 2025 * Whole Number 357

148

Leon Goodman, probably introduced me to the $5 1934B NY $5 212 intermediate face.

Chuck O’Donnell used to call the intermediates Philippine numbers because they

resembled in size the plate serial numbers on the Philippine notes printed at the BEP during our

occupation of those islands.

I got lucky once in a modest way with $1 1974 FRNs with intermediate back 1821. They

started to appear around 1975. I was down from Laramie, Wyoming, visiting my in-laws in

Claremont, California, when we went out for dinner at a nearby restaurant one Sunday. In getting

change from the cashier, I noticed she was peeling off $1s from a new pack, from which she handed

me three. I looked at their backs and saw that one was an 1821. I hurriedly asked where the

restaurant banked and she pointed to a branch bank down the street.

I was at that bank Monday morning asking the head teller if I could buy some new $1s. I

had a little over $400 with me so in due course she obtained that amount from the vault. I gleefully

noted that every fourth note had an 1821 back. I had a lot of fun trading them around. People

seemed to want four consecutive notes from those packs so they could have their 1821 bookended

by the three notes with normal plate serial numbers.

The Federal Reserve $1 1988A notes printed at the Fort Worth plant bearing large face

plate serial number 106 are a slightly different animal than the intermediate plate serials profiled

above. They were created the same way though.

Fort Worth notes printed from 32-subject plates are deliberately distinguished from those

printed in Washington, DC, by having: (1) an FW prefix in front of the face plate serial number

and (2) large plate serial numbers on the backs. The heights of the plate serial numbers on the faces

of both Washington, DC, and Fort Worth notes printed from 32-subject plates are identical having

heights equal to the height of the FW prefix letters on the Fort Worth notes. In the case of Fort

Worth $1 face 106, the engraver accidentally dialed in the large size reserved for the backs.

I’m mentioning 106 here owing to it having the same cause, a wrong setting being made

on a pantograph machine. Bob Kvederas Jr. was one of the first to discover the variety right after

the September 11, 2001 tragedy. He is the author of catalogs on the popular Web Press $1 FRN

Figure 6. Fun note with an 80 percent second generation offset transfer of the

face onto the back of a $1 1974 FRN with intermediate back 1821. This note was

won by Tom Conklin at the Society of Paper Money Collectors Tom Bain Raffle

at the 2001 International Paper Money Show.

SPMC.org * Paper Money * May/June 2025 * Whole Number 357

149

.notes. His discovery was made while the notes were still in the pipeline so it created quite a stir.

Bob even found the variety on some star notes.

Plate serial numbers are added to printing plates by engravers who etch the numbers into

the surface of the plates. The area where the numbers occur on a plate are coated with a resin. The

engraver uses a pantograph etching machine to scribe the number through the resin onto the plate.

The pantograph machine has a template with numbers that the engraver traces and the machine

mechanically reduces them to the desired size as it scribes several subjects at a time onto the plate.

This process produces a trace of the number through the resin onto the plate surface. Next, the

engraver puts a drop of acid on the resin and the acid etches the number to the desired depth into

the surface of the plate so it can hold ink. The acid etching process is sped up by placing an

electrode onto the drop of acid and applying a current through it.

The pantograph machines have an adjustment that governs the size of the plate serial

numbers. Once in a great while, the operators dial in the wrong setting.

Figure 7. This note is a real sleeper because you have to know subtle technical

details to spot it. The large size of the plate serial number on the face of this $1

1988A is the size reserved exclusively for back plate serial numbers printed at the

Fort Worth plant. The normal height for 106 should be the same as the FW prefix.

SPMC.org * Paper Money * May/June 2025 * Whole Number 357

150

You Collect. We Protect.

Learn more at: www.PCGS.com/Banknote

PCGS.COM | THE STANDARD FOR THE RARE COIN INDUSTRY | FOLLOW @PCGSCOIN | ©2021 PROFESSIONAL COIN GRADING SERVICE | A DIVISION OF COLLECTORS UNIVERSE, INC.

PCGS Banknote

is the premier

third-party

certification

service for

paper currency.

All banknotes graded and encapsulated

by PCGS feature revolutionary

Near-Field Communication (NFC)

Anti-Counterfeiting Technology that

enables collectors and dealers to

instantly verify every holder and

banknote within.

VERIFY YOUR BANKNOTE

WITH THE PCGS CERT

VERIFICATION APP

The Panic of 1907 and

Secretary of the Treasury Cortelyou’s

3% Certificates of Indebtedness

Purpose

The objective of this article is to describe how the Treasury Department under the leadership of

Secretary of the Treasury George Cortelyou created an increase in the volume of national bank notes to

help stem runs on banks and to offset hoarding of currency attending the severe but short-lived Panic of

1907. His measure temporarily created approximately $40 million in new national currency that was

injected into the nation’s economy between November 1907 and the end of November 1908. The well-

publicized announcement of this infusion of new money into the national banking system had a

Matt Hansen

Lee Lofthus

Peter Huntoon

Figure 1. $50 Act of June 13, 1898, one-year 3% Certificate of Indebtedness issued during the Panic of 1907

with a November 20, 1908, maturity. A specimen of the face was sold by Stack’s in 2010 for $34,500. National

Numismatic Collection photo.

SPMC.org * Paper Money * May/June 2025 * Whole Number 357

152

calming effect on the public about the safety of the banking system, so mid-November 1907 marked the

turning point toward recovery from the panic.

Cortelyou’s $40 million injection increased total national bank circulation by 5.8 percent as of

December 31, 1907. Particular attention will be focused on the unorthodox issuance of $50 one-year 3%

Certificates of Indebtedness authorized by the Spanish-American War funding Act of June 13, 1898. Those

certificates secured $15,436,500 of new circulation, which alone represented 26 percent of the spike in

national bank note circulation between November 15 and December 31, 1907 (Cortelyou 1908a, p. 126).

The Panic of 1907

The global Panic of 1907 resulted from the collapse of a speculative bubble, the beginning of

which is attributed to the suspension of the Knickerbocker Trust Company in New York City on October

22, 1907. Trust companies in New York operated under state charters and were bank-like institutions that

accepted deposits subject to withdrawal—and were subject to runs. They loaned to speculators in industries

and the stock market. The Knickerbocker Trust was brought down by a run ignited by news of failed loans

to speculators who were attempting to corner the stock of United Copper Company, a ploy that unraveled.

(Moen and Tallman, 2015).

A domino collapse of public confidence quickly spread first within New York City to other

leveraged trust companies, and then beyond to banks in general. Runs developed across the country and

Figure 2. Knickerbocker Trust Company, 352-364 Fifth Avenue, New York City. The Panic of 1907 was

triggered by the suspension of this institution on October 22, 1907. Wikipedia photo.

SPMC.org * Paper Money * May/June 2025 * Whole Number 357

153

the stock market swooned, producing an

economic paralysis second only to the future

Great Depression. Currency vanished from

commerce as massive hoarding ensued.

Although severe, the panic began to

subside in mid-November. By the beginning of

1908, the premium on currency disappeared as

public confidence in the banking sector began

to return (Cortelyou, 1908a, p. 12).

Panics and Banking in 1907

It is necessary to spell out how money

panics such as occurred during 1907 impacted a

bank in order to understand how Secretary of

the Treasury George Cortelyou attempted to

mitigate those impacts. The immediate problem

faced by the banks was withdrawals of deposits

and hoarding of the cash that severely weakened

them and deprived the economy of liquidity that

allowed it to function.

Stepping back, there were two major

weaknesses that plagued the national banking

system in 1907. There was no deposit insurance

at the time and national banks had an inherently

brittle structure.

The lack of deposit insurance was

particularly onerous. In reality, each depositor

was investing in the success of the bank.

Depositors were relying on the integrity and business acumen of the bank management to protect their nest

eggs with no recourse should things go wrong. Therefore, all bank depositors were a continually nervous

lot who would run for the exit with their money at the slightest hint of a problem.

The issue of brittle banks was more subtle. Each national bank was a stand-alone corporate entity

that had to endure economic stresses on its own. There were no provisions for pooling risk between banks

that could be brought to bear if one ran into trouble. Specifically, if customer confidence in a bank fell,

runs on the bank developed whereby its depositors withdrew their money, thus weakening the bank by